OPINION:

Maximizing national economic growth through tax cuts/reform is the key to a bright future for our nation, despite the PelosiSchumer propaganda blitz that our tax reform legislation only helped Wall Street, corporations and the rich.

The Republican congressional majority and President Trump showed us how to stimulate economic growth, through tax reform/tax cuts and deregulation after years of President Obama’s economic stagnation. In less than 2 years, economic growth reached 4 percent more than double Mr. Obama’s anemic 1.2 percent per year.

At 4 percent economic growth, the economy doubles every 18 years. After another 18 years, the economy doubles again, making it 4 times as large as it was. After another 18 years (about half a century), it doubles again making it 8 times as large. However, at an annual growth rate of 1.2 percent (the “new normal” according to Mr. Obama’s economists) it would take 60 years for the economy to double in size. Rapid growth is what made America the greatest economic and military power in world history, and why the economic growth rate is absolutely key to our nation’s wellbeing and financial survival.

Millions of new jobs have been created, driving the unemployment rate below 4 percent. Unemployment among blacks and Hispanics has been reduced to its lowest level in American history. Unemployment among women is at its lowest in more than 65 years (since 1953), making this the most inclusive recovery in American history.

Tax reform reduced taxes by over $2,000 for average families. It cut the rates on middle-class incomes. It helped the poorest and lower income more by nearly doubling the standard deduction and doubling the child tax credit to $2,000 per child.

Before tax reform, American companies labored under the highest corporate income tax rates in the industrialized world at nearly 40 percent, counting state corporate rates. By contrast, the average in Asia was 20.1 percent, in Europe 18.9 percent. Cutting the federal corporate rate to 21 percent merely moved America closer to parity worldwide.

What moved those countries to reduce their corporate rates in recent years were economic studies, like those by Larry Kotlikoff at Boston University and Alan Auerbach at Berkeley, which confirm that most of the corporate income tax is actually borne by workers in lost jobs and wages. Mr. Kotlikoff and Mr. Auerbach estimate that tax reform’s corporate tax rate cuts will increase wages for average workers by $4,000 annually, besides direct tax cuts of over $2,000 per year.

Economic growth requires private sector investment to expand businesses, start new businesses and create jobs. A key incentive to make such investments comes from lower tax rates. But progressive Democrats don’t seem to understand incentives, let alone economics.

That is why we could be in trouble with this new Democratic House of Representatives. They pledged to reverse the tax reform tax cuts, a tax increase which would cause renewed Obama-type stagnation. They are unlikely to achieve that because the Republican Senate would not go along and Mr. Trump has the presidential veto.

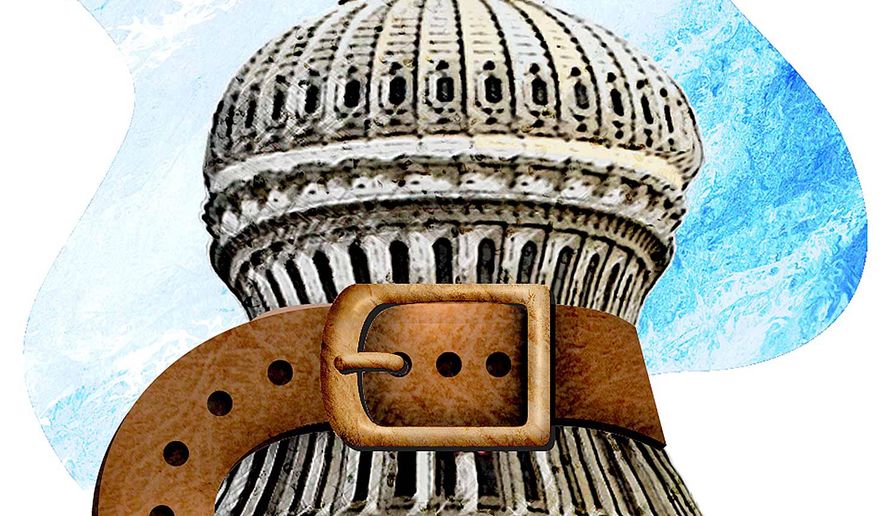

But big-spending liberals can stand in the way of much needed “right-sizing” of government that must accompany — and protect — strong and lasting national economic growth.

Ronald Reagan believed deeply in what he called “limited government” without knowing — or having solid evidence to confirm — how to quantify and define “limited government.” Only since his presidency has a body of knowledge emerged — worldwide — as to the “optimal” or “right-size” of government that would maximize a nation’s economic growth rate — defining “limited government.”

The economists who developed the optimal size of government thesis and parameters, led by the late Gerald Scully, Bill Niskanen, Richard Rahn, Richard Vedder, Lowell Galloway, Dick Armey, and Bob Lawson, concluded that whenever a nation taxes and spends more than 1820 percent of GDP (at all levels of government, including the “costs” of government regulation) it has gone beyond the “right”/”optimal” size of government. Currently, the U.S. government is at 21+/- percent, state/local governments are at approximately 15 percent, and the “cost” of regulations at all levels of government are about 5 percent of GDP. Therefore, U.S. governments together are more than twice as large as they should be.

Our nation — with sustained, dynamic economic growth — stands on the brink of working our way out of (what is essentially) national bankruptcy if we seriously constrain and limit the growth of federal/state/local governments’ spending and taxation during this period of sustained, private sector economic growth aiming to reach the optimal size.

Sens. Schumer and Pelosi (and Sanders, Warren and the newly elected progressives) will spend the next two years trying to increase the size of government, keeping pace with the growth of the economy. That’s where we must stop them as we work diligently to take back the full reins of the federal government (and as many state and local governments as possible) in 2020.

• Lewis K. Uhler is chairman of the National Tax Limitation Committee and Foundation. Peter J. Ferrara is a fellow with the Foundation and teaches economics at Kings College in New York.

Please read our comment policy before commenting.