OPINION:

President Trump is being criticized by both parties for his continued pledge that he will not cut Social Security and Medicare benefits. Liberals are frustrated because they so desperately want to run TV ads against Mr. Trump rolling grandma over the cliff in her wheelchair.

Conservatives complain that taking entitlements off the table means no real progress can be made in bringing down the debt and near trillion dollar deficits. They point to estimates of tens of trillions of dollars in unfunded liabilities in the old-age programs and the warning that both programs will be broke by 2034.

We support sensible market-based reforms that will reduce Medicare’s runaway costs and that will give young people a much better payback from the raw deal of Social Security. For the vast majority of those under age 35, the Social Security problem isn’t that benefits are going to be too high — but way, way too low given how much is going to be snatched from their paychecks over the next 30 or 40 years.

The threats of fiscal Armageddon, however, are fairly easily avoided however with one major policy objective: Faster economic growth. Mr. Trump has made this point, and so has his National Economic Council chairman, Larry Kudlow. They’re absolutely right.

What may surprise people is how little additional real GDP growth would be required to accomplish this.

The fiscal gloom among the bean counters is being driven by the absurdly low GDP growth forecasts. These tend to be the same economic pessimists — people like Larry Summers — who said Mr. Trump would never be able to achieve 3 percent to 4 percent growth and yet here we are.

The latest “Long-Term Budget Outlook” from the Congressional Budget Office forecasts real GDP growth of 1.90 percent, with the Social Security Trustees chiming in at 2.00 percent. If this is really the best America can do, then we should fire all the hoards of economists in Washington for malpractice.

It is true that real GDP growth was only about 1.9 percent under Presidents Bush and Obama, but the number was 3.8 percent under President Clinton, 3.7 percent under President Reagan and well over 3 percent for the 20th century as a whole (despite the Great Depression). Accordingly, the right name for the economic theory being pushed by the Keynesian/Progressive crowd is “secular stupidity.”

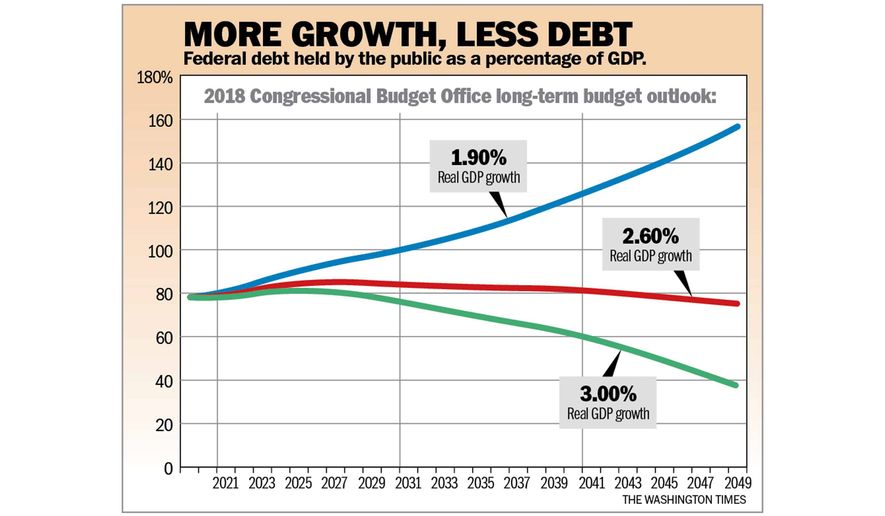

The next question is: What growth target will get the debt down? As shown in the graph, if GDP growth over the next 30 years were to average a mere 2.60 percent rather than 1.90 percent, the projected fiscal disaster vanishes. And, this includes Social Security and Medicare. The further we go out into the future with this higher growth target, the lower the debt levels become. This is because the compounding effect of faster growth far outpaces the pace of entitlement spending — even with the aging of the population.

Next, look what happens with 3 percent growth. Federal debt as a percent of GDP would be cut in half by 2048.

Some of our friends lecture us that “you can’t grow out of the Social Security and Medicare problem.” Nonsense. Higher GDP growth would raise real wages, and this would cause Social Security (but not Medicare) spending to rise. However, the average U.S. worker is 26 years away from retirement, and Social Security benefits become less generous as wages increase. In other words, the more money you make, the worse your return is from Social Security. This is why revenues from faster growth would overwhelm rising Social Security benefit costs.

What about the tens of trillions of dollars of unfunded liabilities in the retirement programs? Increasing GDP growth to 2.6 percent (from 1.9 percent) would increase total real ($2018) federal revenues over the next 75 years by 40 percent, or $255 trillion. At 3.00 percent growth, we would see an increase of 68 percent, or $450 trillion. These kinds of tidal waves of revenues will turn fiscal Armageddon into a fiscal salvation.

So faster economic growth should be the policy fixation of our elected officials. Anything that grows the economy faster today — like the tax cut — will pay off in spades over the decades to come. Higher growth now with greater productivity and innovation, means a higher living standard for Americans every year in the future and the prime beneficiaries of faster growth today are our children, grandchildren and their children.

Mr. Trump is a growth optimist and realist. During the 2016 campaign, candidate Trump promised that he could and would raise the growth rate. So far he has delivered. GDP growth for the first 7 quarters under Mr. Trump has averaged 2.8 percent, which is vastly higher than the 1.7 percent seen during the last 7 quarters under Mr. Obama.

Perhaps even more significant, GDP growth for the first three quarters after the Trump tax cuts took effect has averaged 3.2 percent, again vastly higher than the 1.6 percent in Mr. Obama’s last year. The growth response from the tax rate cuts has already added about $4 trillion to the Congressional Budget Office’s 10-year GDP estimate.

By the way, from 1995 to 2000 under President Clinton (and a Republican Congress) the budget deficit disappeared and turned into a surplus even as taxes were cut in 1997. That happened because of spending control and a burst of 4 percent growth that almost no one thought possible. The tidal wave of revenues overtook government outlays. That’s the formula we need now.

• Stephen Moore, a columnist for The Washington Times, is a senior fellow at the Heritage Foundation and the author with Arthur Laffer of “Trumponomics.” Louis Woodhill is a Texas-based economic analyst.

Please read our comment policy before commenting.