President Trump’s aggressive trade policies are forcing some tough customers to cut new deals, with China talking about opening its market to U.S. companies and South Korea nearing a deal to reduce steel exports and buy more American cars.

The threat of a trade war gave Wall Street the jitters when Mr. Trump rolled out big tariffs and other get-tough measures, but it also rattled Beijing, Seoul and other trading partners.

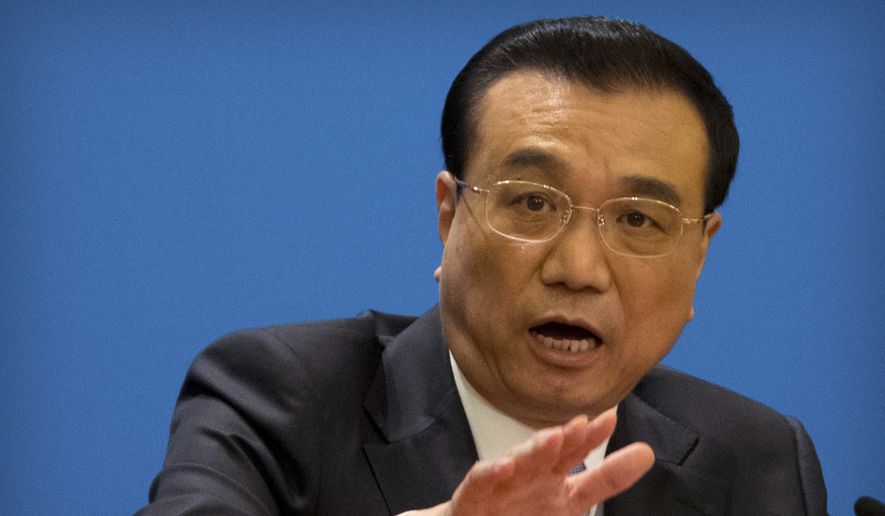

Chinese Premier Li Keqiang said Monday that Beijing wanted trade talks and not a trade war with the U.S. He stressed his country’s willingness to remove barriers to American business and reduce the U.S. trade deficit with China, which is the chief demand from Mr. Trump.

“With regard to trade imbalances, China and the United States should adopt a pragmatic and rational attitude, promote balancing through expansion of trade, and stick to negotiations to resolve differences and friction,” Mr. Li told a conference in Beijing, state radio reported.

The U.S. stock market, which went into a nosedive Thursday when the Trump tariffs were announced, rallied Monday on news of a breakthrough with China.

The Dow Jones industrial average soared more than 669 points, or 2.84 percent, a veritable mirror image of the 724-point tumble Thursday.

SEE ALSO: Wilbur Ross: Chinese response to import changes shows they don’t want a trade war

Mr. Trump cheered the turnaround on Twitter: “Great news! #MAGA.”

Beijing badly wants to head off Mr. Trump’s crackdown, said David M. Lampton, director of China studies at Johns Hopkins University’s School of Advanced International Studies.

“They will hold out the promise of gradual but consistent change. How much the administration will accept by the way of promises is yet to be seen,” he said. “In the past, China has basically for many years made more promises than it has delivered on.”

Still, he expects China to make concessions to the U.S. financial services industry and “probably draw a clearer road map about how they will open up some areas of China’s economy.”

Mr. Trump last week socked China with up to $60 billion in tariffs on high-tech imports, investment restrictions and plans for a formal complaint to the World Trade Organization.

The beefed-up “America first” policies crack down on what the president calls China’s unfair trade practices and theft of intellectual property.

Beijing responded with a $3 billion list of U.S. goods including steel and pork that it would hit with reciprocal tariffs unless Washington quickly negotiates a settlement.

“We’re not afraid of a trade war, but that’s not our objective,” Treasury Secretary Steven T. Mnuchin said on “Fox News Sunday.” “In a negotiation, you have to be prepared to take action.”

Earlier tariffs that the Trump administration slapped on steel and aluminum imports also spurred serious renegotiations of deals with some of America’s top trading partners, including South Korea and the European Union.

Seoul and Washington have reached a deal that exempts South Korea from the tariff but restricts its steel imports with quotas, according to an outline of the agreement released Monday by the South Korean Trade Ministry.

The two sides agreed in principle to terms of the deal, known as Korus. A formal announcement is not expected until later this week.

The quota is set at 70 percent of the average of steel sales to the U.S. from 2015 to 2017.

Other concessions by South Korea include not reimposing a tariff on cars that Seoul has lifted, relaxing Korean safety standards that U.S. cars didn’t meet and upping the number of U.S. cars allowed from 25,0000 to 50,000.

Mr. Mnuchin called the deal “an absolute win-win.”

A flurry of behind-the-scenes negotiations between the U.S. and China produced several concessions by Beijing.

The talks, first reported by The Wall Street Journal, involved Mr. Mnuchin and U.S. Trade Representative Robert Lighthizer in Washington and Liu He, China’s newly appointed vice premier overseeing the economy, in Beijing.

In a letter to Mr. Liu, Trump’s team asked China to cut a tariff on U.S. autos, buy more U.S.-made semiconductors and give U.S. firms greater access to the Chinese financial sector.

China has offered to buy more U.S. semiconductors by diverting some purchases from South Korea and Taiwan, the Financial Times reported, citing people briefed on the negotiations.

China imported $2.6 billion of semiconductors from the United States last year.

Chinese officials are also rushing to finalize rules by May instead of the end of June that will allow foreign financial groups to take majority stakes in Chinese securities firms, the Financial Times said.

Critics of the tariffs, including free trade conservatives, said Mr. Trump was adopting China’s tactics.

“Control of individuals’ trade and investment decisions by the central government is a trait of communist governments like China’s, not market-oriented governments like America’s,” said Bryan Riley, director of the conservative National Taxpayers Union’s Free Trade Initiative. “The Trump administration’s unilateral trade actions may not make China more like the United States, but they will make the United States more like China. In that respect, Americans have already lost.”

• Dave Boyer contributed to this article.

• S.A. Miller can be reached at smiller@washingtontimes.com.

Please read our comment policy before commenting.