California’s newly enacted gas tax may be running on fumes.

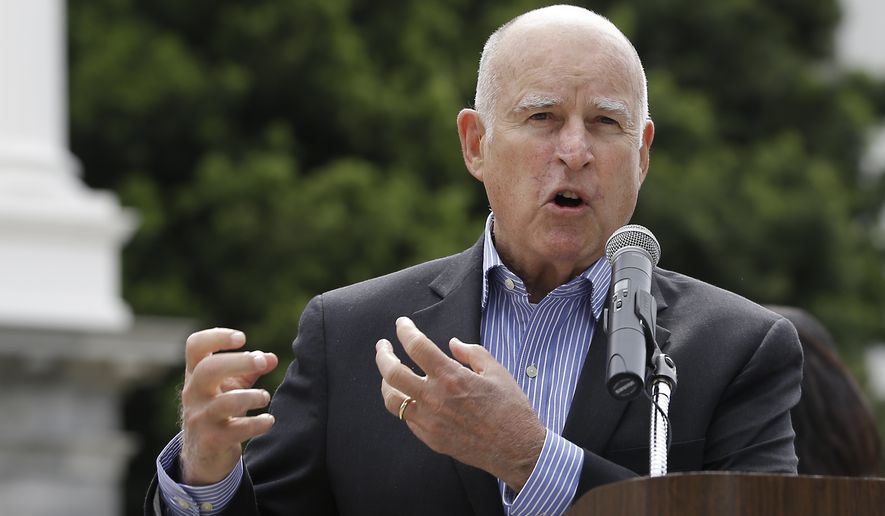

Dave Gilliard, consultant for Give Voters a Voice, said the campaign plans to go above and beyond in submitting petitions next week for a ballot measure to repeal the vehicle-fee and fuel-tax increases signed into law last year by Democratic Gov. Jerry Brown.

The repeal effort has gathered nearly 900,000 signatures, far more than the 585,407 valid signatures required to qualify for the November 2018 ballot — and the deadline isn’t until May 21.

While the signatures must still be verified by the Secretary of State’s office, supporters are optimistic.

“That outpouring of voter disgust with the car and gas tax hikes should be a message that Sacramento politicians should hear loud and clear,” said Carl DeMaio, head of Reform California, at a Thursday press conference in San Diego.

Californians already paid some of the highest fuel prices in the nation before Senate Bill 1, which raises the state tax on gasoline by 12 cents and on diesel by 20 cents per gallon along with state vehicle fees.

The car-fee hike took effect Jan. 1, while the fuel-tax bump hit in November and will ultimately be indexed to inflation, which means “it’s going to go up continually unless this is repealed,” said Mr. Gilliard.

“With this latest tax increase, we’ll be paying in California an average of a dollar a gallon more than other states that have better roads,” he said. “So there’s something wrong with the priorities at the statehouse. It’s not that we don’t pay enough. We pay too much.”

Democrats say that the tax hike is needed to improve and repair deteriorating local roads, state highways and mass transit, although critics point out the funding cannot be used to relieve California’s clogged highways by expanding road capacity.

Whether the additional tax revenue, estimated at $5.2 billion per year, will actually go toward fixing infrastructure is also up for debate.

“They [Californians] see what happens to that money,” said Mr. Gilliard, whose group has raised $2 million to qualify the measure for the ballot. “The legislature diverts it to other projects and programs. They’ve been doing that for decades in California.”

The repeal’s opponents, including Democrats, labor unions and municipalities, have countered with Proposition 69, an initiative on the June 5 ballot that would put the additional revenue in a “lockbox” reserved for “transportation purposes.”

“Proposition 69 ensures our transportation tax dollars can only be used to make road safety improvements, fill potholes, repair local streets, freeways and bridges, and to invest in public transit,” said the Yes on 69 campaign.

The Sacramento County Republican Party wasn’t convinced, saying the measure was meant to “trick voters,” noting that “transportation purposes” could include high-speed rail.

Democrats have lined up against the repeal, led by Mr. Brown, who in his State of the State address in January declared, “I will do anything in my power to defeat any repeal effort that gets on the ballot, you can depend on that.”

The Yes on 69 campaign argued that repealing SB1 would “jeopardize public safety” by delaying repairs to “cracked, potholed roads” and hurt the economy by eliminating jobs associated with road improvements.

Backing the repeal are free-market groups including the Howard Jarvis Taxpayers Association as well as Republican gubernatorial candidates Travis Allen and John Cox.

In addition to throttling the tax, the initiative would also make it tougher for state lawmakers to pull off another hike by requiring any future tax or fee increases on fuel and vehicles to go before the voters.

The proposed repeal also enjoys strong support among working-class voters, said Mr. Gilliard.

“We are very confident that once it makes it on the ballot, voters will repeal [the gas tax] and send a message to the legislature to get their priorities straight and use the money they’re already collecting to repair roads,” he said.

• Valerie Richardson can be reached at vrichardson@washingtontimes.com.

Please read our comment policy before commenting.