After watching their health care bill devolve into a partisan morass, a group of prominent Republicans is pushing to make sure the next big fight over tax reform doesn’t go down the same path.

The chairmen of the key tax-law committees say they think there’s a chance for bipartisan cooperation, with House Ways and Means Committee chief Kevin Brady saying he’s already begun asking Democrats for input on the next steps forward.

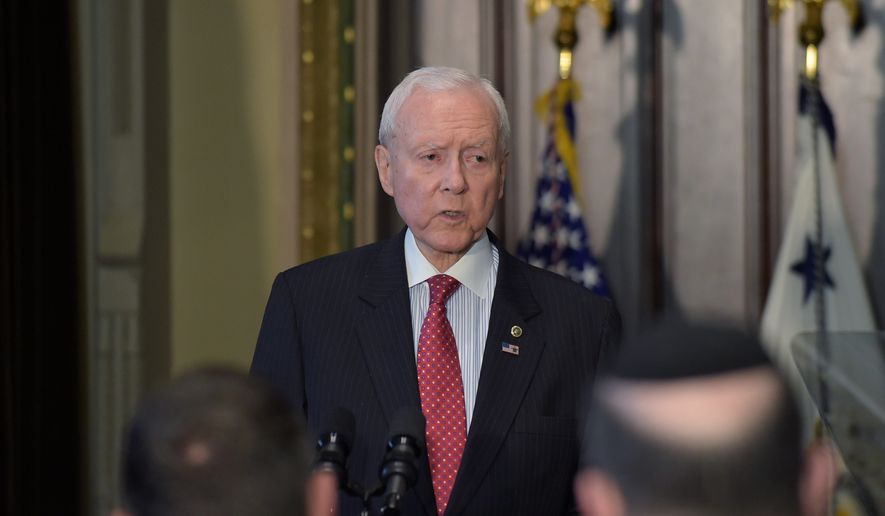

Senate Finance Committee Chairman Orrin G. Hatch has also opened lines of communication with panel members, but he recently chided Democrats for throwing up partisan roadblocks such as demands that President Trump release his tax returns.

“Despite these unreasonable demands, I will once again state that I am more than willing to work with my Democratic colleagues on tax reform, and I sincerely hope that at least some of them will be willing to do so,” Mr. Hatch, Utah Republican, said in a recent floor speech.

But GOP leaders aren’t convinced.

Senate Majority Leader Mitch McConnell says Republicans and Democrats don’t even share the same aims for a tax overhaul — the GOP wants to unleash the economy, while Democrats want to use the tax code to punish the wealthy and shift money to the poor, he says.

Without common ground on the aims, the Kentucky Republican said, there’s little sense in trying to write a bill together. He’s preparing to use the powerful but tricky budget tool known as reconciliation, which allows major changes to pass without having to face a Democratic filibuster.

Conservative lawmakers in the House are just as adamant that trying to accommodate Democrats’ demands would be futile.

“Fact of the matter is we are the party of low taxes, they are the party of high taxes. We’re going to pass it with reconciliation,” said Rep. Andy Harris, Maryland Republican and a member of the ultraconservative House Freedom Caucus. “Why would we want Democrat input on a tax bill? We know what their answer is: Raise it.”

The GOP’s recent fits and starts on health care don’t really change the calculus on securing Democratic buy-in for tax reform, said Rep. Mark Meadows, North Carolina Republican and chairman of the Freedom Caucus.

“I think that’s aspirational instead of actual,” he said.

Rep. Raul R. Labrador, Idaho Republican and a Freedom Caucus member, said he does think there are some conservative Democrats who would vote for tax reform, but questioned whether Senate Minority Leader Charles E. Schumer is willing to accept concessions on the other side.

“I welcome any Democrat who wants to work with us on these ideas,” Mr. Labrador said. “But if their concept is we have to scrap our ideas and do their idea, then of course we’re not going to be able to do anything on a bipartisan basis.”

Democrats say the GOP is learning the wrong lesson from the health care debate. They said Republicans are facing political troubles at home and difficulties on Capitol Hill because they’ve gone it alone.

Democratic leaders said the GOP should instead follow the model of the spending bill that cleared Congress last week, where Republicans consented to nearly every demand by the minority party, earning a large bipartisan vote in both chambers.

Mr. Trump devoted much of his most recent weekly address to tax reform, saying he’s proposing the “single largest tax cut in American history” in a plan that consolidates individual rate brackets and lowers the corporate tax rate from 35 percent to 15 percent.

“Our tax relief will be focused on the middle class, including much-needed relief for low- and middle-income parents raising children,” the president said.

But an aide said the Trump administration has not had direct outreach with Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, or any of the other Democrats on the panel on tax reform.

Using the budget process to power a bill through along partisan lines comes with severe limitations. Under Senate rules, the legislation couldn’t add to the federal deficit beyond a 10-year budget window. That severely constrains what the GOP may be able to do.

“If you go under reconciliation, this has got to be revenue-neutral or better,” said Rep. Tom Cole, Oklahoma Republican. “And that’s extremely hard to achieve without doing some things that are pretty controversial.”

• David Sherfinski can be reached at dsherfinski@washingtontimes.com.

Please read our comment policy before commenting.