OPINION:

Zurich, Switzerland | “It was the best of times, it was the worst of times” (with apologies to Dickens). Despite the attempts to unify Europe into an economic and partial political whole over the past 70 years, the grand experiment is unraveling, and it increasingly looks like the Humpty Dumpty we call Europe cannot be put back together again. Parts of Europe are enjoying unparalleled freedom and prosperity, but other parts are sinking both economically and politically. What explains the growing divergence?

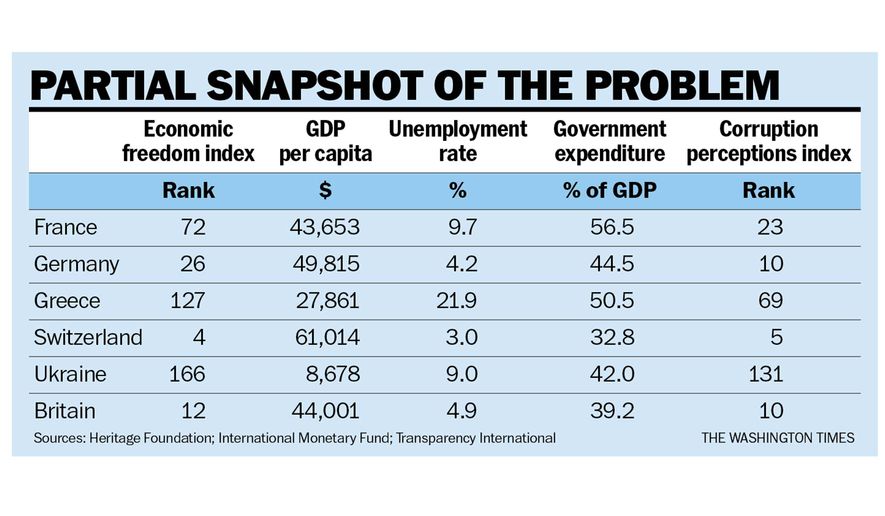

The enclosed table is a partial snapshot of the divergence problem. Greece, France, Germany and the United Kingdom (until it completes its withdrawal) are part of the European Union. Ukraine was a wannabe and is almost certain to forever suffer that unfulfilled desire. Switzerland never wanted to be in the EU, and history is once again proving it made the right decision. A Swiss friend once said to me: “It is not that we Swiss are smarter than others, but we have a cumbersome political system, so by the time we get around to doing something, other countries have proven it to be a bad idea, so we don’t bother.”

The two poorest countries in my table are actually going backward with declining real incomes. The Greeks on average are about one-third poorer than they were just a few years ago. Rarely in peacetime has any democratic country experienced such a fall in income. Ukraine, unlike most of the other former communist countries of Eastern Europe and the Soviet Union, has stagnated with virtually no growth in real incomes in the past quarter of a century.

At the other end of the scale, the Swiss get a bit richer year by year, now having surpassed the United States in real per capita incomes, and the Germans and the British continue to muddle along. The French, who on average were considerably richer than the British before Mrs. Thatcher and her economic revolution, now have fallen behind the British.

The different outcomes can be almost fully explained by corruption or the absence thereof, and the degree of economic freedom. Economically free countries tend to have much higher real per capita incomes than those that are not, and hence it is no surprise that Switzerland is far richer than the others because it is the most free and has an honest and competent judicial system. In contrast, Ukraine has weak institutions, including the courts, which often are part of the corrupt system rather than a force for law and order.

The Greek self-imposed tragedy is well known. The Greek government and other institutions and individuals in Greece borrowed more in euros than they could or were willing to repay. The creditors, such as the Germans, have insisted on full or at least partial repayment. After living on borrowed money for many years, the Greeks have found that the loan trough has run dry, and they are now being required to service their debts, which has drained the country of investment capital and sharply cut disposable incomes.

The Swiss, the Germans and the British have a long cultural tradition of believing that honorable people repay their debts — others, not so much. Conflict arises when the creditors are serious about debt repayment and the debtors have a more casual attitude toward their obligation to repay.

The global evidence is overwhelming that the wealth or poverty of any country has little to do with natural resources, but is primarily dependent on sound fiscal and monetary policies, strong institutions, and traditions of individual responsibility. Venezuela has the world’s largest oil reserves, but the socialist government has squandered it all, leaving its people hungry and short of basic necessities. Switzerland has no natural resources to speak of and not even a seaport, but almost all the people in this beautiful land live well.

Once economies begin to diverge, both capital and skilled workers flee the dysfunctional economies and move to those that offer more opportunity. Ukraine continues to lose its best and brightest — a massive brain and skills drain. By contrast, about a third of the workers in Switzerland were born elsewhere but have brought their energy and skills to further build the Swiss economy.

Divergence, rather than convergence of national economies, is not healthy. If you have the best house in a poor neighborhood, you do not sleep as well as you would if your neighbors were richer. It is the self-interest of rich countries to help poor countries become wealthier — not through handouts, which only perpetuate the basic problems, but by providing carrots and sticks for policy and institutional changes.

If the Greeks had to sell some of their islands to the Germans to pay their debts, the safe bet would be that those islands would be far more prosperous under German administration in three decades than others that remained under Greek administration.

Think about the possibility: If badly managed nations had to put up some of their territory as collateral for loans, over time the more prosperous and freer countries would grow, both in physical size and population, and the more corrupt nations would shrink. A world that had more people living under the Swiss governance and economic system would be wealthier, freer and nicer.

• Richard W. Rahn is chairman of Improbable Success Productions and on the board of the American Council for Capital Formation.

Please read our comment policy before commenting.