In California, a state known for its love of driving, high-priced gasoline and history of tax revolts, a rebellion is brewing against Gov. Jerry Brown’s massive gas-and-car tax increase.

In the two weeks since the Democrat signed Senate Bill 1, opponents have launched an initiative drive to repeal the $52.4 billion transportation package as well as a recall campaign to eject a vulnerable Democratic state senator who is seen as the deciding vote for the law.

“The voters are enraged,” said Assemblyman Travis Allen, the Orange County Republican behind the repeal initiative, which is pegged to the November 2018 ballot.

Gas is already expensive in California — the state vies with Hawaii for the nation’s highest per-gallon prices — and SB1 will make it more so by dinging motorists with a 12-cent-per-gallon excise tax hike on gasoline, a 20-cent increase on diesel and higher vehicle registration fees in order to fill potholes, repair roads and bridges, and expand mass transit.

What has Mr. Allen fuming is that lawmakers pushed through the largest fuel tax hike in state history without bringing it before the voters. Instead, they cobbled together a two-thirds vote in both houses of the Democrat-controlled Legislature with no votes to spare.

Only one Republican — state Sen. Anthony Cannella — voted in favor of SB1, and that was after his Central Valley district received $500 million for a commuter rail extension and completion of a parkway to the University of California, Merced.

“The California voters were absolutely left out of the loop,” said Mr. Allen. “There was certainly not substantive buy-in from the California people, who, according to all of the polling data, are overwhelmingly against raising gas taxes.”

In Fullerton, three Southern California radio talk show hosts kicked off a campaign Thursday to recall state Sen. Josh Newman, a first-term Democratic legislator who barely edged out his Republican opponent in November, in retaliation for his vote.

“That’s the only thing that works, is to take one of their team members out, politically,” said Ken Chiampou, who hosts with John Kobylt “John and Ken” on KFI-AM in Los Angeles. “If there’s no consequence, no punishment, then they’re going to keep right on doing this crap.”

The Los Angeles hosts, joined by Carl DeMaio of KOGO-AM in San Diego, drove home the point by launching their recall campaign at an Arco gas station.

They were backed by Jon Coupal, president of the Howard Jarvis Taxpayers Association, who announced the formation Thursday of Californians Against Car and Gas Tax Hikes in order to target Mr. Newman, whose Senate District 29 is based in Brea.

“For years, the state has been diverting gas tax revenue away from roads, only now, with this massive 43 percent tax increase, are they promising to fix them,” Mr. Coupal said in a statement. “We have heard this before, but the only thing Californians can count on is higher taxes.”

The organizers are no strangers to ballot fights. Mr. DeMaio was instrumental in placing pension reform before San Diego voters in 2012, and “John and Ken” fueled the 2003 recall of Democratic Gov. Gray Davis.

Mr. Newman was chosen for a reason: “He barely won. He’s unknown. He’s only been in office a few months, and it’s a district that’s been the scene of other recalls,” Mr. Kobylt said.

“Plus, we have a lot of audience there,” he said. “It’s one of our strongest areas. It was picked for all the right reasons. If you’re going to do something, you want it to have a good chance of working.”

California voters have a history of turning against their state leadership. They ignited a national tax revolt by passing Proposition 13 in 1976 and stunned the Democratic establishment by turning out Mr. Davis over an energy crisis and an increase in vehicle licensing fees.

Since then, however, the state has undergone a political shift to the left as middle-class residents leave for less-expensive pastures, raising doubts about whether California has enough feisty anti-tax voters left to upend SB1.

“The state has drifted leftward in the past decade, so the prospects for another tax revolt are questionable,” said John J. Pitney, a politics professor at Claremont McKenna College. “But if the economy goes down or gas prices shoot up, anti-tax sentiment could surge again.”

The new law is expected to raise $5.2 billion per year over 10 years. The fuel tax hikes take effect on Nov. 1, and the additional “transportation improvement fee” assessed on each vehicle kicks in on Jan. 1.

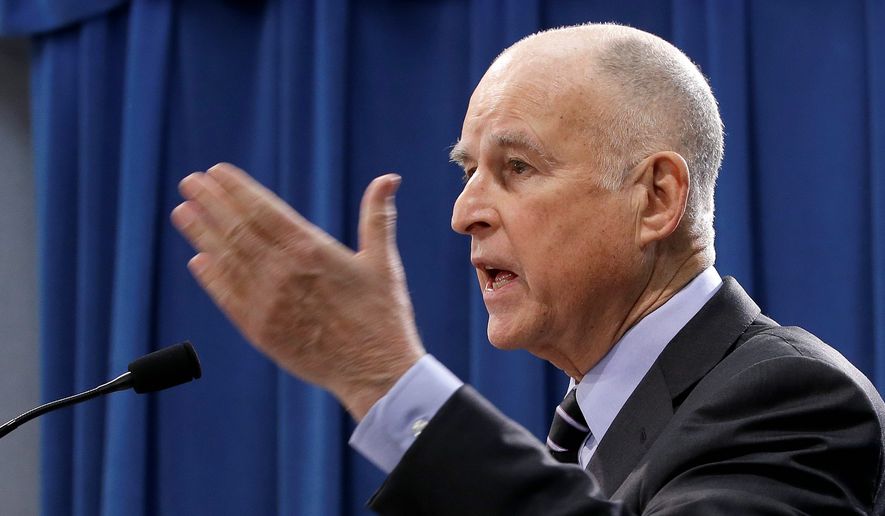

“Safe and smooth roads make California a better place to live and strengthen our economy,” Mr. Brown said in his April 28 announcement. “This legislation will put thousands of people to work.”

In response to criticism that the Legislature routinely diverts road repair dollars to the general fund, lawmakers agreed to place a constitutional amendment on the June 2018 ballot that bars SB1 funding from being used for anything but transportation.

None of the funding goes to creating new roads or expanding existing ones, which irks opponents, given the state’s well-known congestion woes.

“This new gas tax will do absolutely nothing to alleviate traffic because it explicitly states that this will not build any new capacity, no new lanes, anywhere in California,” said Mr. Allen. “So if Californians don’t like their traffic today, they’re going to like it even less in the future when they’re stuck in the exact same traffic and paying even more for their fuel.”

The repeal’s odds of success may be presaged by the outcome of the recall. The proposal needs 63,593 valid signatures by Oct. 16 to qualify for the ballot, but Mr. DeMaio predicted on the air that it would take as little as six weeks to meet the threshold.

Mr. DeMaio, a former San Diego City Council member, said the recall has been dismissed in Sacramento as “nothing more than just a bunch of radio talk show hosts just stirring the pot,” but that the political winds may be shifting.

He said the scuttlebutt is that a Democratic state senator recently “screamed at her colleagues, in particular the state Senate leader Kevin de Leon. She said that she’s hearing an earful from her constituents on this car-and-gas tax, and she feels like they made a bad decision.”

Mr. Newman is taking the recall seriously. He has hired the San Dimas political consulting firm Overland Strategies to help fight the recall effort and defended his vote in an interview on the “Hourly Struggle” podcast.

“It wasn’t an easy vote,” Mr. Newman said. “I don’t like raising taxes. I asked I think appropriate questions as to: ’Is this necessary, what are the alternatives?’ And again I was persuaded that in the current fiscal environment that there weren’t alternatives. That was the basis for my vote.”

In addition, Mr. Brown has taken the unusual step of agreeing to headline a May 23 fundraiser for Mr. Newman in Sacramento, according to the Los Angeles Times.

“When voters learn the facts on the recall effort, I don’t think they’re going to be too happy about a special election being pushed on false pretenses by a failed politician from San Diego and which is going to cost the taxpayers over $2 million,” Mr. Newman said in a statement. “It’s just more politics as usual, and it’s exactly what I ran to change in the first place.”

Still, the recall proponents say they like their odds. “We’ve gotten a tremendous response,” Mr. Kobylt said. “It’s more response than we’ve gotten on anything in several years.”

• Valerie Richardson can be reached at vrichardson@washingtontimes.com.

Please read our comment policy before commenting.