OPINION:

Every day there are legions of new economists who dismiss the Donald Trump economic agenda and his forecast of 3 percent growth as a wild-eyed fantasy. The consensus is that the economy “can’t possibly grow at 3 percent” says The Wall Street Journal. “Slow growth is the new norm, so get used to it,” writes Rucir Sharma, Morgan Stanley, chief global strategist at Morgan Stanley in Foreign Affairs magazine this month.

Question: Why does anyone bother to listen to economists anymore? The profession has become an embarrassment and the most respected economists have shown themselves to have as much predictive power on where we are headed as the gypsies who read tarot cards.

Almost all of the economics profession — with a few, ahem, exceptions — bought into the Keynesian idea that what would revive the economy after the Great Recession of 2008-09 was massive government spending “stimulus.” The trillions of dollars of government borrowing here and abroad created a decade-long anemic recovery. The number of jobs created under the Obama stimulus turned out to be fewer than the number we would have had if the government had done nothing — according to the Obama White House’s own analysis. So we got $9 trillion of debt with almost nothing to pay for it.

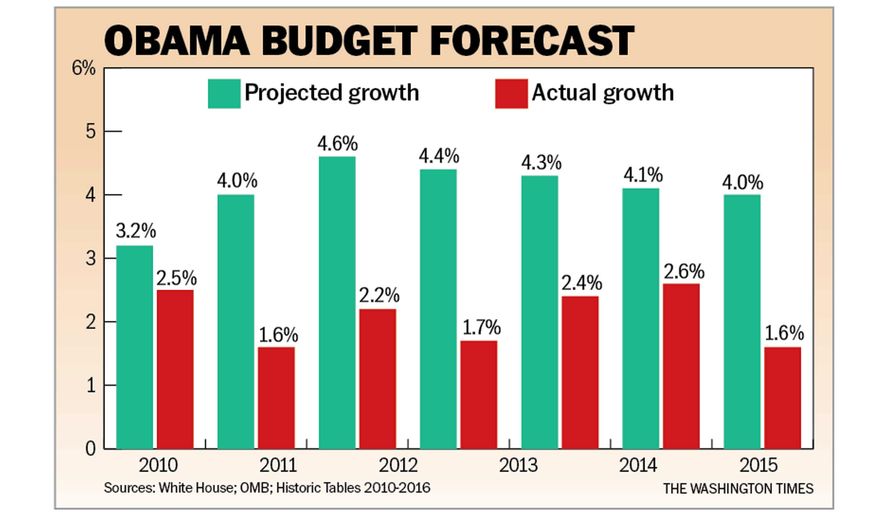

Amazingly, every Obama budget forecast that annual growth would reach 3.5 to 4.5 percent. Bullish growth was just around the corner (remember Joe Biden’s “Summer of Recovery” tour?) The chart shows the Obama forecasts versus reality.

We never got growth above 3 percent under President Obama and the average growth was 2 percent ending at 1.6 percent. Reality was about 1.5 percentage points below projection, which was about an 80 percent overestimate of growth. Maybe we should have just hired the gypsies with tarot cards. Their predictions couldn’t have been any worse.

So now the very people who made these preposterous forecasts are telling us 3 percent growth is a fantasy under President Trump. Under their model, tax increases create 4 percent growth, but tax cuts can’t get us to 3 percent growth.

The major reason we are told we can’t get growth is that we have so many millions of baby boomers retiring. But we have 100 million people over the age of 16 outside the labor force today or unemployed, and that’s a giant labor pool to get workers from. Most of them are young, not old. This is a gigantic pool of workers to tap into if Washington would stop spending $1 trillion a year paying people not to work.

Another fallacy is that this long recovery means the economy is due for a recession. No. For much of America this has been a long recession, not a long recovery. We are suffering from a severe growth deficit. The economy is $3 trillion behind where it should be because of the shallow recovery. So the economy is teed up for a boom not a bust.

How do we ignite that boom? Nearly every policy during the Obama years was anti-growth — tax increases, minimum wage hikes, Obamacare, Dodd-Frank regulations, massive debt spending, the Paris Climate Change accord, an EPA assault against American energy, massive expansions of programs like food stamps and disability — and on and on. If Mr. Trump is able to to shift those policies into reverse — especially by getting tax rates down, not up — 3 to 4 percent growth is easily achievable and the economics profession will be proven dead wrong again.

• Stephen Moore is an economic consultant with FreedomWorks and senior economic analyst at CNN.

Please read our comment policy before commenting.