After spending more than $22 million on the Dakota Access pipeline protest, North Dakota wants to make sure any paid activists remember to submit their state income taxes.

Tax Commissioner Ryan Rauschenberger said his office is keeping an eye out for tax forms from environmental groups that may have hired protesters to agitate against the 1,172-mile, four-state pipeline project.

“It’s something we’re looking at. I can tell you I’ve had a number of conversations with legislators regarding this very issue,” said Mr. Rauschenberger. “[We’re] looking at the entities that have potential paid contractors here on their behalf doing work.”

It’s no secret that millions have been funneled into the six-month-old demonstration via crowdfunding websites, and that more than 30 environmental organizations, including the Sierra Club, Indigenous Environmental Network, Food and Water Watch, 350.org and Greenpeace, have backed the protest.

If national environmental organizations are paying protest personnel, they’re not saying so publicly. Still, Mr. Rauschenberger said red flags will be raised if he doesn’t start seeing W2 or 1099 tax forms from those affiliated with the protest arriving at his office.

“It’s something we could possibly pursue if we don’t see 1099s coming in for the activity,” Mr. Rauschenberger said.

SEE ALSO: Army to proceed with Dakota Access pipeline North Dakota lawmakers say

The ongoing demonstration has been costly to the state. Sen. Heidi Heitkamp, North Dakota Democrat, issued a plea last week for federal help with unruly protesters, some still camped out on federal land, after President Trump moved to expedite the pipeline review.

North Dakota lawmakers asked repeatedly for aid from the Obama administration without success.

“After five months of protests, over 600 arrests related to those protests, and more than $22 million in North Dakota taxpayer dollars spent on law enforcement resources to keep North Dakotans safe during the protests, state and local law enforcement agencies are in dire need of federal support,” Ms. Heitkamp said in her letter.

Morton County Sheriff Kyle Kirchmeier has criticized “paid agitators” who crossed the line from peaceful protest to lawbreaking by trespassing on private property, blocking highways and bridges and throwing rocks, feces and burning logs at law enforcement.

“If an organization is directly paying someone to come and do activities on their behalf, even protesting — if they’re receiving income and they’re here in North Dakota performing activities for an organization, they owe income tax from Day One,” Mr. Rauschenberger said. “And that entity should be issuing 1099s. Just like a contractor.”

Whether protesters would be required to report income based on crowdfunding donations falls into more of a gray area, he said.

“I think a lot of people think that, ’Oh, if something goes through GoFundMe, it’s just always considered a gift.’ But it can also be used as a way to funnel money just like an employer paying a contractor,” Mr. Rauschenberger said. “It can be a way to funnel money as well, and very well could be taxable. I’m not saying it is. I’m saying it could be. And it’s really on a case-by-case basis.”

He said the IRS has issued a “loose guidance” on crowdfunding. In general, such income is considered exempt if it represents a gift to be repaid, a purchase of an equity interest or a gift without any expectation of repayment.

Rob Port, who runs North Dakota’s Say Anything blog, said the crowdfunding donations are often framed as payment for services provided. He has tabulated at least $11.2 million in contributions to the DAPL protest.

“If those receiving the money didn’t use it in attempting to block the pipeline, I think those giving the money would be upset. They’d feel cheated,” said Mr. Port. “That certainly seems like a quid pro quo relationship to me. That seems like one person paying another person in pursuance of a specific endeavor.”

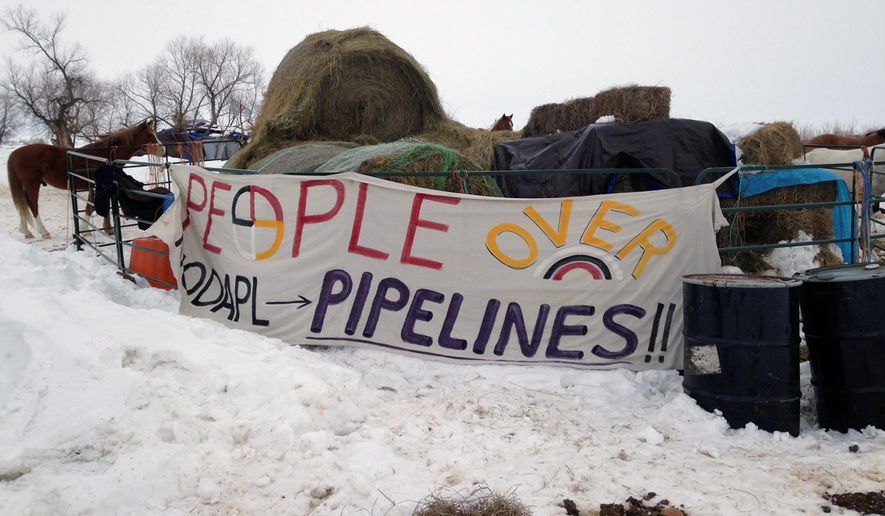

Several hundred protesters have braved the harsh North Dakota winter in their ongoing effort to stop the $3.8 billion project over fears about its impact on water quality.

The Standing Rock Sioux tribal council has asked occupiers to leave, citing environmental damage and looming spring flooding at some camps, even though the tribe has led opposition to the pipeline.

Mr. Rauschenberger emphasized that the state isn’t looking into the tribe’s financial relationship with protesters, only off-reservation activity. In addition, contributions such as food and shelter would be considered in-kind donations and not subject to taxation.

“The paper trail for something like that would be probably nonexistent,” he said. “We’d be looking at cash, whether it was a check, cash or debit card issued for performing services as opposed to more of the in-kind. It would be too difficult from an enforcement standpoint. We’d be looking at the cash money trail.”

Any paid protesters would owe income tax in North Dakota if their total income in 2016 exceeded $10,350.

Enforcing the tax code may also come down to whether the costs exceed the benefits. There are rumors that some of the thousands of protesters who moved in and out of camps starting in August were being paid with hard-to-track debit cards, and the state tax division has a staff of 128.

“It all comes down to resources,” Mr. Rauschenberger said.

• Valerie Richardson can be reached at vrichardson@washingtontimes.com.

Please read our comment policy before commenting.