OPINION:

Stop me if you’ve heard this story before. Governors and state legislators are pleading poverty again and they are demanding tax hikes of every imaginable kind.

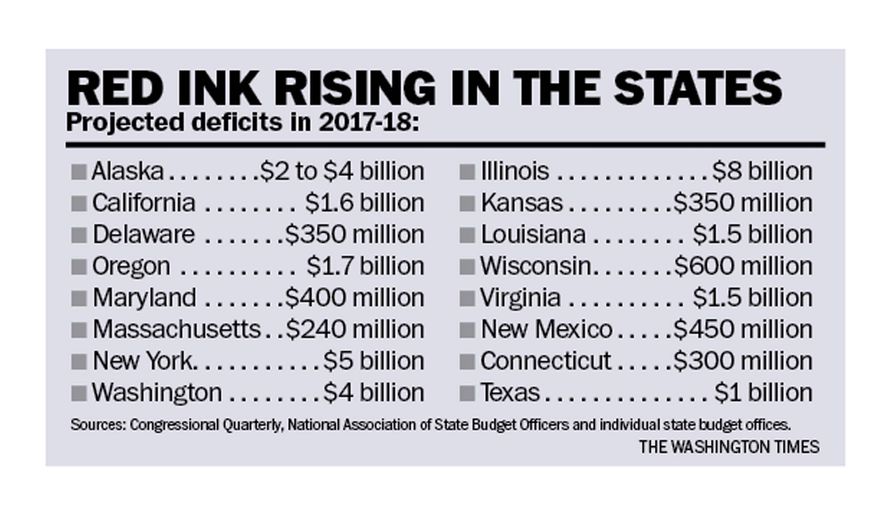

More than half the states are facing big deficits this year and they are mostly blue states like California, Connecticut, Delaware, Illinois and New York and Oregon. (See chart.) These are the highest tax states with some of the deepest pools of red ink. There’s got to be a message here.

But many red states have money woes too, and we now have Republicans chomping at the bit to raise taxes. The biggest fight is in Kansas where the Republican-dominated legislature recently passed a massive income tax hike that would raise taxes on every small business in the state and every wage earner with income above $15,000. Fortunately, Gov. Sam Brownback vetoed the Republican tax hike but they will be back.

Republican governors Bill Haslam of Tennessee, Mary Fallin of Oklahoma and Eric Holcomb of Indiana want gas tax increases. Republicans in Alaska and Wyoming are considering enacting a state income tax to fill funding holes. These are two of the nine states without an income tax.

So what is the source of the budget crises from coast to coast? First, on the revenue side, tax receipts are down because states are front-line victims of the slow-growth era of the Obama years. When the U.S. economy sputters at only 1.6 percent as it did in 2016, state and local tax revenues barely trickle in. So much for the liberal spin that President Obama left behind a healthy economy.

Revenues are also way down in oil-producing states like Alaska, Kansas, Oklahoma, North Dakota, and Wyoming. Liberals are pushing big tax increases in each of these states that not so long ago gorged on new spending during the years of high prices. North Dakota had one year that the budget rose more than 50 percent.

The best thing Washington can do to help states is pass the Trump tax cuts so we get faster economic growth. Nothing heals state budgets quicker than a dose of prosperity.

The even bigger story is the eight-year state spending binge that almost no one is reporting on. Chris Edwards, a fiscal analyst at the Cato Institute, has run the numbers. He reports that “state general fund spending has soared 32 percent since 2010.” The National Association of State Budget Officers predicts a 4.3 percent hike in fiscal 2017 budgets.

One reason state budgets have spun out of control is Obamacare. Some 20 million Americans have been added to state Medicaid rolls. For now, the feds pay most of the costs. But in several years the patients will still be on Medicaid but the costs will be shifted to the states. All the more reason to repeal Obamacare as rapidly as possible before the Medicaid caseloads grow by millions more.

It’s worth noting that many of the blue states that signed up for the Obamacare Medicaid expansions now face the biggest deficits.

Will tax hikes solve the problem? The answer can be found in Connecticut and Illinois. These two states passed multi-billion dollar income tax hikes “on the rich.” Both have seen their economies get crushed by the out-migration of tax filers to avoid the tax hikes. Today their deficits are still gigantic. Connecticut faces a near half-billion dollar deficit with Democratic Gov, Daniel Malloy calling for his third mega-tax increase to stop the red ink. Illinois has at least $6 billion in unpaid bills following its biggest tax increase in history.

Spending discipline and pro-growth tax reforms are the best formula for reviving state budgets. If Republicans who control 69 of the 99 state legislative chambers think they can tax their way back to prosperity, don’t be surprised if they find themselves back in the minority after 2018.

• Stephen Moore is an economic consultant with Freedom Works and a CNN senior economic analyst.

Please read our comment policy before commenting.