OPINION:

It was in 1916 — 100 years ago this year — that America made a big, big mistake that has done significant damage to our economy and the fairness of our tax system for an entire century. We are talking about the estate tax, more popularly known as the death tax.

The tax is in the news again because Hillary Clinton wants to raise the tax at death from 40 percent to 45 percent and impose it on far more small family-owned businesses, farms, and ranches. (This woman just seems to love taxes.) Donald Trump says eliminate this unfair tax because a lifetime of paying income taxes, sales taxes, property taxes, dividend taxes, capital gains taxes, payroll taxes and employee taxes should be enough. Almost every small business association in America agrees and has endorsed the Trump plan.

Why is this tax so un-American? Because many small business owners who want to pass their family legacy on to their kids and grandkids (what is wrong with that?) tend to be asset rich but cash poor, meaning their businesses may appear quite valuable on paper but in many cases they lack the cash to shell out 40 percent of the businesses value to the IRS when the parent owner dies.

When the kids don’t have the cash on hand to pay a sizable tax bill on their parents’ life savings, they must sell off equipment or land, lay off workers, and in the worst cases dissolve the family business to pay Uncle Sam’s ransom. What a travesty. Sell the farm to pay the taxes.

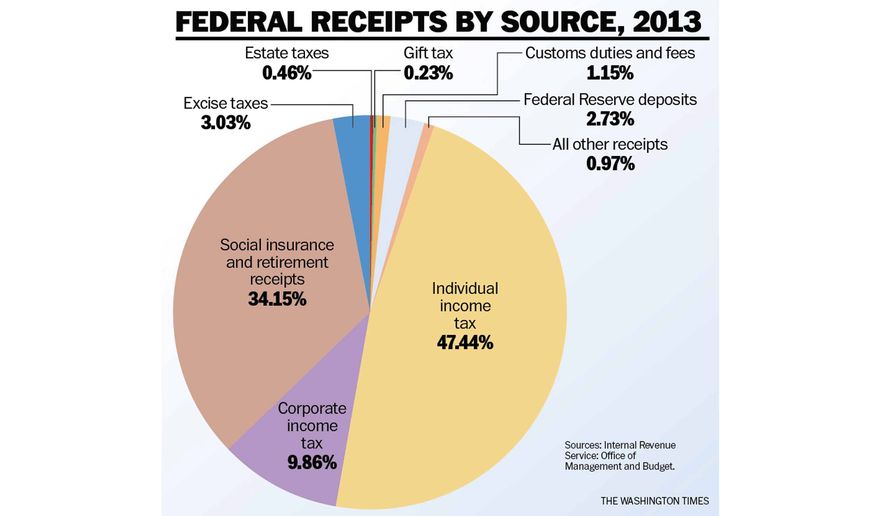

So why does the left insist on raising this tax, rather than killing it? The only answer we can think of is greed. Amazingly, this tax raises almost no revenue. In 2014 the estate tax collected — hold on to your hats — 0.43 percent of all federal revenues. (See chart) It raises less than the government spends every 48 hours.

But to get that tiny morsel of revenue, the tax does substantial damage. Really rich people like Warren Buffett and Bill Gates engage in complicated and costly estate tax planning with the best lawyers money can buy to avoid paying the tax. Both Mr. Gates and Mr. Buffett put billions into a massive charitable foundation, run by family members, in part to avoid death taxes. So the superrich almost always find ways around this sinister tax. It’s the smaller businesses without clever tax accountants that get clobbered.

Hillary Clinton may be the biggest hypocrite of all. She says the Trump plan is a tax break for millionaires and billionaires like him. Yet Hillary and Bill have gone to great lengths to shelter their own fortune from the death tax, by using sophisticated trusts and moving their New York home into the Clinton Foundation to shield it from taxation, according to a Bloomberg analysis, all while pushing for higher death taxes on small businesses.

The Clintons want one set of tax laws for the rest of the country while they and their friends skate free under a separate set of rules. Family businesses owners who are too busy sweeping up the shop floor or herding cattle to mount a coordinated national public relations response are collateral damage.

Voters don’t buy into the liberal death tax raid. The public is overwhelmingly in favor of Mr. Trump’s plan to kill the death tax. Consistently 60-70 percent of voters when polled favor full repeal of the federal estate tax. New polling this year by YouGov, the same pollster used by the liberal New York Times, has shown that voters from purple Virginia, to red South Dakota, to blue Washington state support repeal (66 percent, 74 percent, and 56 percent respectfully).

Voters maintain a strong instinctive feeling that no person should have to visit the grim reaper and the tax man in the same day. Also, most Americans may not be rich, but most want to be rich, and if they get there, they don’t want the government helping itself to half the spoils.

Even Hillary’s Veep pick, Sen. Tim Kaine of Virginia gets it. Upon the elimination of the Virginia death tax a few years ago, he beamed: “I applaud lawmakers for repealing Virginia’s estate tax. This action protects family-owned small businesses and farms, and helps keep the Commonwealth competitive with more than two-dozen other states that have already taken this action.” He should educate his running mate.

Most importantly, the unhindered transfer of wealth is one of the most vital characteristics of a prosperous economy. Growth is enhanced in America when each generation hands down an endowment of assets and knowledge to the next. We don’t build great empires so that the government can take half of it or more at one’s death. One reason so many people keep working hard even late into their lives is to leave a family legacy to their children, and then to allow them to pass on that business or farm to their children. We’ve learned through history if the kids and grandkids live their lives like a drunken playboy, the wealth will quickly disappear. If they expand the business, it means more jobs, more wealth, and more tax revenues and a better life for their children.

This is the process we call the American Dream.

Hillary wants to tax that dream away.

• Steve Moore is an economic consultant with Freedom Works and an economic adviser to presidential candidate Donald Trump. Palmer Schoening is chairman of the Family Business Coalition in Washington, D.C.

Please read our comment policy before commenting.