OPINION:

Hillary Clinton took another sniper shot at Donald Trump’s tax reform plan last week by calling it “a tax cut for billionaires” like him. She even argued that Mr. Trump “spends” trillions of dollars on the tax cuts. Question: How do you spend money on a tax cut?

As Ronald Reagan would say: “well, there they go again.” Tax cuts for the rich is the boilerplate attack line against tax rate reductions. We’ve heard this every time a tax cut has been floated for the last 30 years.

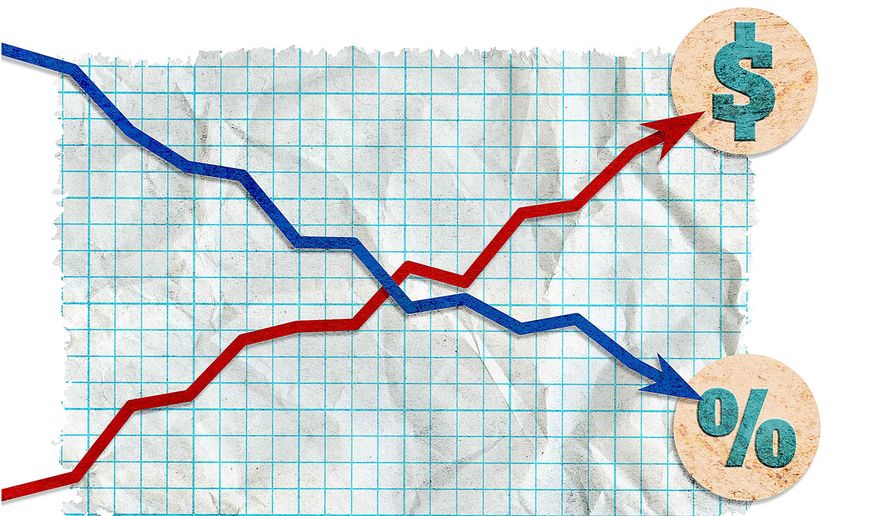

But this criticism isn’t even close to historically accurate. Many times tax rate cuts — including in the 1960s under John F. Kennedy and in the 1980s under Mr. Reagan — have raised tax revenues from the wealthiest tax filers because lower rates reduce incentives for tax avoidance and recharge the batteries of the economy and grow taxable incomes.

In both the 1960s and 1980s supply side tax cuts were followed by increased revenues. As Larry Kudlow puts it in his soon to be released book on the JFK tax cuts: “We had six percent growth and the tax payments by the wealthiest filers nearly doubled. We had quarters of six percent growth back then.” After the Reagan cuts, the share of taxes paid by the top 1 percent rose from 19 percent in 1980 to above 25 percent in 1988, according to IRS tax return data. In other words, tax cuts are like performance enhancing drugs — and these are legal.

The heart of the Trump tax plan is to cut our business tax from the highest in the world down to 15 percent, making our rate one of the lowest. This will reverse the stampede of businesses fleeing out of America — great companies like Burger King and Medtronics. When the businesses come back, so will good paying middle class jobs.

Small businesses — the backbone of our economy — will benefit too. Their tax rate falls from close to 40 percent to 25 percent, because business owners pay taxes at the personal income tax rate. This will allow companies to invest more and hire more workers here at home. Getting rid of tax loopholes will help pay for these reductions.

Hillary, meanwhile, has hinted at raising the top income tax rate to as much as 50 percent. Business owners will pay above 60 percent of that extra tax. Raising taxes on employers is no way to get them to hire more workers.

The latest Commerce Department reports tell us that one of the weakest areas of the economy now is in business investment spending. The rate was negative for the last six months, which is a lead indicator of troubled waters ahead. Hillary Clinton has even complained that businesses aren’t investing enough, but she wants to raise taxes on dividends and capital gains.

The Trump plan would reward investment going forward by chopping the capital gains and dividend tax rates to 20 percent from closer to 24 percent. I’ve advised Mr. Trump to cut that rate down to 15 percent, but 20 percent is a start.

Hillary says that Mr. Trump has no way to pay for this tax cut. Wrong.

Mr. Trump has an aggressive government downsizing plan. He would repeal the costly and ineffective Obamacare law and replace it with consumer driven care. Obamacare promised to save $2,500 per family — but most families and businesses are seeing premiums skyrocket in cost.

The Trump plan will dramatically expand drilling for American energy, and reopen coal mines that have been closed under Mr. Obama. Thanks to new drilling technologies America will become the number one oil and gas producer in the world — creating millions of new high-paying union jobs, raising royalty money for the government, and reducing our trade deficit.

Mr. Trump also favors the “penny plan” cutting one cent of every dollar from government programs — except Social Security and interest payments — for five years. This will save trillions over the next decade.

The biggest deficit we need to urgently fix is our growth deficit. We must pump up our GDP growth from the anemic 1 percent rate of Mr. Obama’s last six months up to a sustained 4 percent for five to 10 years.

Here are some amazing statistics from the Congressional Budget Office. If you raise the growth rate by one percentage point over one decade it reduces the budget deficit by $3 trillion. If Mr. Trump can juice growth from 2 to 4 percent then poof, federal borrowing disappears by $6 trillion.

Liberal economists pout that this kind of growth is impossible for America, but that’s what people said in the miserable 1970s, but Mr. Reagan (and JFK before him) proved that with the right policy incentives that get government off the back of business, a new era of prosperity is just around the corner.

• Stephen Moore is an economic consultant with Freedom Works.

Please read our comment policy before commenting.