OPINION:

Later this week or next, Congress will take up legislation to rescue the commonwealth of Puerto Rico from its financial crisis that is getting worse by the day.

Puerto Rico faces more than $70 billion of debt and the government is already in technical default on many of its bonds. Billions more come due in the weeks ahead and the government says they are out of money to repay.

These debts don’t even include an additional $43.2 billion of unfunded pension liabilities. Add it all together and the debt reaches at least 150 percent of GDP. That’s a lot of weight on the shoulders of the Puerto Rican people. All the government has done is raise taxes, with the sales tax recently hiked from 7.5 to 11 percent. Tragically, Puerto Rico has become the Detroit of the Caribbean.

By law Puerto Rico can’t declare bankruptcy but the territory is in de facto chapter 9 already.

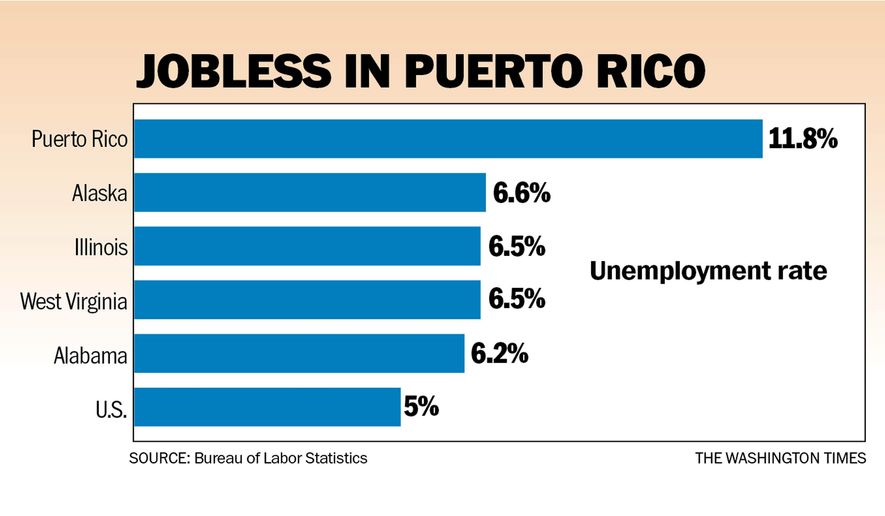

Republicans in the House have drafted a rescue plan that would allow the island to restructure its debt and delay payments as it attempts to rebuild its shattered economy. The statistics are heartbreakingly bleak: almost half the residents are in poverty (and more than half of all children), only about 40 percent of adults are even in the workforce, half of families collect welfare benefits, and more than 10 percent of the island’s residents have left for Florida, Texas, New York, or other safe havens.

Puerto Ricans are American citizens whose lives have been turned upside down. The U.S. government has a moral, if not legal, obligation to help. But as a territory Puerto Rico needs to agree to help itself.

Here is what shouldn’t happen: a financial cash bailout from U.S. taxpayers. Puerto Rico is 100 percent responsible for all of its taxes and spending save its social security tax and spending. As such, U.S. taxpayers had no say whatsoever in the amount of debt Puerto Rico took on and should not have to pay for Puerto Rico’s bad decisions. A U.S. bailout would only reward bad behavior and finance another spend-and-borrow binge.

The government of Puerto Rico, many Democrats on Capitol Hill and the media have invented a story here that the villains are the investors and institutions like hedge funds who bought the PR bonds. The bondholders are certainly not guiltless for lending money to a government that is recklessly out of control. Bondholders will surely pay a heavy price for their financial mistake — they are likely to get at most 70 cents for each dollar they are owed. So the bondholders will be punished by the marketplace.

The real source of the crisis is the P.R. government itself. Puerto Rico’s own elected government has failed its citizens. Even on the eve of the crisis, P.R. continued to spend and borrow as if they were running a Bernie Madoff ponzi scheme.

The Republican plan that has the support of House Speaker Paul D. Ryan, would create a strong financial oversight board to take control of the government’s finances, taxes and budgeting decisions. This is an absolute must because the government in San Juan has proven itself incapable of governing. We know this model works. In the 1990s it helped save Washington, D.C. during its darkest hours of financial troubles. Now the city is booming.

Democrats like minority leader Nancy Pelosi are once again accusing Republicans of trying to turn the island into a “colonial” state. This is absurd and offensive. The Republican plan offers a financial life raft for the island and we believe that if the Puerto Rican legislature or voters prefer to go it alone, they should have a simple up or down vote on whether to agree to a control board.

The thorny and controversial issue is how to restructure the outstanding debt. There are at least a dozen classifications of bonds and the bondholders do have a legal right to repayment or to be able to sue in court.

About one-quarter of the debt carries a constitutional “full faith and credit” guarantee of repayment granted by the government of Puerto Rico.

Those constitutionally guaranteed bond holders must be put first in line for repayment as is consistent with their legal rights. The Republican plan as currently written would take away their right to sue in court and we find this to be an improper taking of their property and their claim on assets. Any legislation should preserve the hierarchy of bond holder claims.

Puerto Rico’s government would like nothing more than a weak control board with no teeth, and the authority to illegally “cram down” a repayment structure without the bondholders’ consent. This would not only be unfair to the bondholders — most of whom are individual investors or pensioners — but it would also hurt Puerto Rico in the long term because only a nitwit would ever again agree to buy P.R. bonds when the island has shown it will blatantly violate contractual obligations.

Congress and Puerto Rico should also learn from history. One of us, Arthur Laffer, worked 40 years ago to save the Puerto Rican economy, which was drowning under its own anti-growth policies. The solution agreed to was a supply side fiscal reform which included cutting the highest personal income tax rate down from 87 percent to 50 percent. The policies worked like a charm.

This brings us to our last and maybe most important recommendation. Why not turn Puerto Rico into a Hong Kong in the western hemisphere through new rounds of tax, regulatory, property rights, and welfare reforms. The first step is to restructure the debt and then jump start the dormant private economy so that the standard of living starts rising again. It worked 40 years ago and it can work again in 2016.

• Arthur Laffer is president of Laffer Associates and Stephen Moore is an economic consultant with Freedom Works. They are co-founders with Larry Kudlow of the Committee to Unleash Prosperity.

Please read our comment policy before commenting.