OPINION:

When I grew up in the north suburbs of Chicago in the 1960s and the 1970s, the state of Illinois was still a financial and industrial powerhouse. The Land of Lincoln had a low rate flat income tax, the property taxes were reasonable, the state ran budget surpluses, and Illinois was the home of such iconic mega-employers as Caterpillar, Sears Roebuck, and the Chicago Mercantile Exchange.

The public schools were pretty good back then and a dedicated corps of teachers put kids first — they didn’t walk out on strike and they didn’t have the fat pensions they can get now when retiring at age 55.

Mayor Richard Daley (“the boss”) ruled Chicago for decades and it was “the city that works.” Yes, you had to pay off the unions to get things done, but this was a cost of doing business. Things did get done.

Fast forward to today and what a sad state of affairs. Last week the state had to embarrassingly announce that it doesn’t even have the money in the bank to pay lottery winners. Now the jackpot winners are suing the state to get their rightful money.

Perhaps the state will need a second lottery to raise money to pay off the winners from the first lottery.

Chicago is so broke that its bonds are junk status and Mayor Rahm Emmanuel had to go hat in hand last week to Springfield for bailout money to pay the bills. According to Forrest Claypool, who is the new chief executive for the Chicago school system: “We are really now at a point where further cuts would reach deep into the classroom.” Teachers have been laid off and extracurricular activities have been cut. Yes, the financial crisis is wreaking havoc, but to ask the state to kick in money is a laughable proposition — like Puerto Rico asking Greece for a loan. Springfield is plum out of money too.

To protest additional service cuts, The Wall Street Journal reports that parents are going on hunger strikes. But it will take more than divine intervention for the cash inflow to meet expenditures.

Why should residents of other states care about this financial meltdown in Chicago and Springfield Illinois. The answer is that Chicago is the canary in the coal mine when it comes to the government pension crisis. Pensions to retired teachers and state employees are bleeding the state dry. Since 2006, annual pension payments have grown tenfold, from $60 million to over $650 million. A state budget office spokesman tells me that “nearly one of three state tax dollars now goes to paying pensions for retired municipal and state employees.”

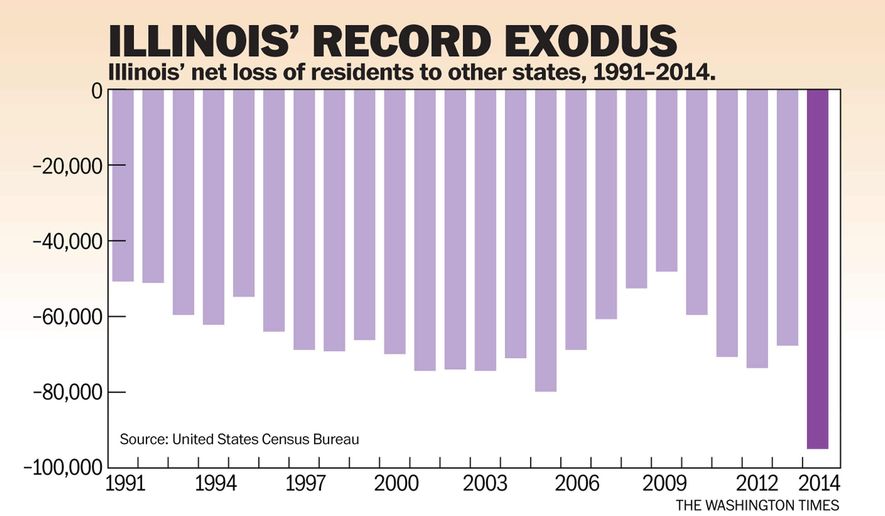

Meanwhile tax increases on the rich under the previous governor failed to raise much money, but did accelerate an exodus of money and talent out of the state. A new Illinois Policy Institute study based on latest IRS data finds a record number of people have been fleeing Cook County. “The income of the people who left Cook County in 2012 was $2 billion more than the income of the people who moved into Cook County … The 2011 and 2012 out-migration will cost the county nearly $30 billion in taxable income over the next decade.”

It couldn’t get much worse, right? Wrong. The state has been operating without a budget new for more than two months. Vendors are routinely going two or three months without getting paid because the vault is empty. The Democrats who rule the state legislature and serve their masters, the Illinois teachers unions, passed a budget this summer that is $5 billion in the red out of a $34 billion budget flouting the state’s balanced budget requirement.

Republican Gov. Bruce Rauner, who inherited this calamity, is the state’s last best hope. He has vetoed the state budget and rejected the unions’ demands for more taxes. Property and sales taxes (which can reach 10 percent at the cash register in Chicago’s Cook County) are already nearly the highest in the nation.

The rich that the unions want to tax have been leaving for Florida and Arizona and Texas. Mr. Rauner argues that Illinois already has one of the five worst business environments in the nation.

Worst of all, the Illinois Supreme Court ruled that pensions can’t be touched because they are contractual obligations. So funding for schools, roads, and public safety get shortchanged so that public employees can keep cashing in on benefits far more generous than what private sector workers/taxpayers receive. This is justice? No wonder residents are going on hunger strikes.

It’s a battle Royale that pits the unions bosses against the taxpayers. And it’s a fight that Mr. Rauner can’t lose. If he does, the exodus from the state will look like the floods of Hungarian refugees trying to get to western Europe.

The shame of all this is that Chicago is a world class city. It is the capital of the Midwest and by far the most desirable city in the region to live in. It should be and could be America’s Hong Kong if it weren’t for the labor agreements that are shredding basic government services and making the city unaffordable.

What is scary is that the fiscal virus that has incapacitated this once great city and state may soon spread to a city or town near you.

Amazingly national Democrats are saying with a straight face that to help American workers and make the country great again we need more powerful unions.

• Stephen Moore is a senior fellow at the Heritage Foundation and a Fox News contributor.

Please read our comment policy before commenting.