The IRS is still investigating 11 cases of political wrongdoing by its own employees dating back to 2013, and had to warn eight others that their behavior was in danger of crossing lines, the Senate’s senior lawmaker revealed Tuesday in a letter probing how the tax agency handles those cases.

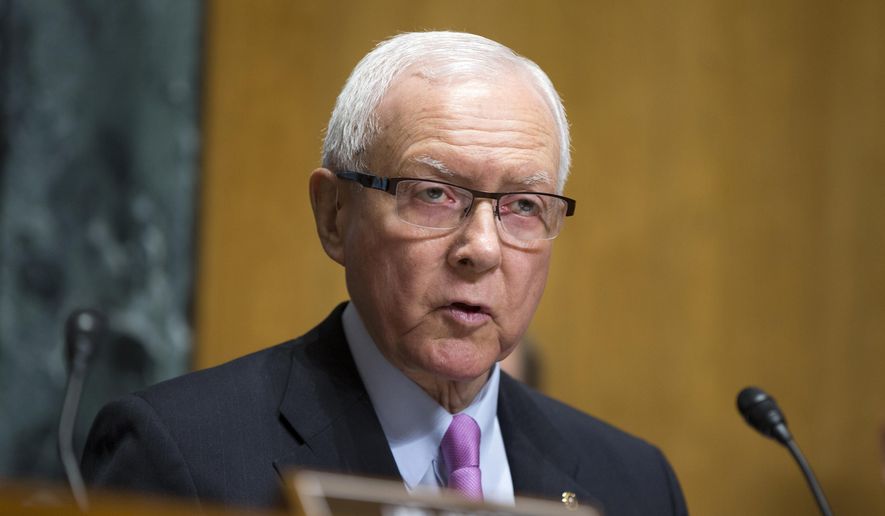

Five other IRS employees quit in the middle of audits of their behavior, bringing the total of potential political wrongdoing cases to 24 over the last two years, Sen. Orrin G. Hatch, president pro tempore of the Senate and chairman of its Finance Committee, said in his letter to IRS Commissioner John Koskinen.

Mr. Hatch, Utah Republican, said he’s particularly interested in how the agency decides whether a complaint of political activity was verified, and what role the labor union for IRS employees plays in the cases.

Reports of political targeting are first investigated by the Treasury Inspector General for Tax Administration (TIGTA), which decides if there is criminal behavior. In cases where investigators find evidence of misconduct but where it doesn’t rise to the level of criminality, they refer the cases back to the IRS to decide how to handle.

The TIGTA made 47 referrals dating back to 2013, Mr. Hatch said. The IRS closed 20 of those cases with a “clearance letter” finding no actual wrongdoing, while the rest range from warnings to resignations to the 11 cases that are still waiting on the IRS — “some dating back a substantial period,” Mr. Hatch said.

The IRS, in a statement Tuesday, said the TIGTA referrals don’t necessarily mean there was wrongdoing, but said when there is misconduct, they take the right steps, including administrative punishment.

“The IRS has more than 80,000 non-partisan civil servants who take pride in serving the nation’s taxpayers, and there are high standards for them to follow,” the agency said. “When questions arise about employee conduct, the IRS works cooperatively with TIGTA. When allegations are proven, the IRS takes appropriate action, up to and including dismissal.”

The IRS suffered a black eye two years ago when the TIGTA revealed the agency had singled conservative groups out for special scrutiny, subjecting their applications for nonprofit status to intrusive investigations and improperly delaying approvals for years.

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.