The rush to join the China’s new development bank for Asia has become a stampede, with even longtime U.S. allies such as Georgia, South Korea, Australia and even Taiwan now saying they are ready to join despite the clear reservations of the Obama administration.

China is putting up half of the planned $100 billion initial capitalization for the Shanghai-based Asian Infrastructure Investment Bank (AIIB), designed to help finance trillions of dollars in infrastructure projects needed for the booming East Asian region in the coming decades.

At least 42 countries are now expected to be “founding members” of the AIIB, up from 21 when China and a group of Asian and Middle East countries formally signed a memorandum of understanding to open the bank last October, including Germany, Britain, France, Switzerland, Turkey and Russia. Beijing has pressed countries to join by the March 31 deadline, saying only founding members will have a say in setting up the AIIB’s initial structure and lending guidelines.

“As one of the founders, you have a better position to influence, like steering [the bank] towards sustainable investments,” said Swedish Finance Minister Magdalena Andersson Monday, shortly after Stockholm became the latest European power to sign on with the bank.

The U.S. have never formally opposed the AIIB idea, but was noticeably cool to the concept. Obama administration officials said they feared the bank would duplicate the work of the World Bank and Asian Development Bank, dominated by the U.S. and its allies, while potentially undermining lending standards on such issues as the environment and corruption.

China and other emerging economies complain they are underrepresented in the existing international organizations such as the World Bank and IMF, and that Asia’s public financial needs are simply not being met by World Bank and ADB.

PHOTOS: See Obama's biggest White House fails

To date, the U.S. and Japan are the only two major players on the outside as the AIIB comes together.

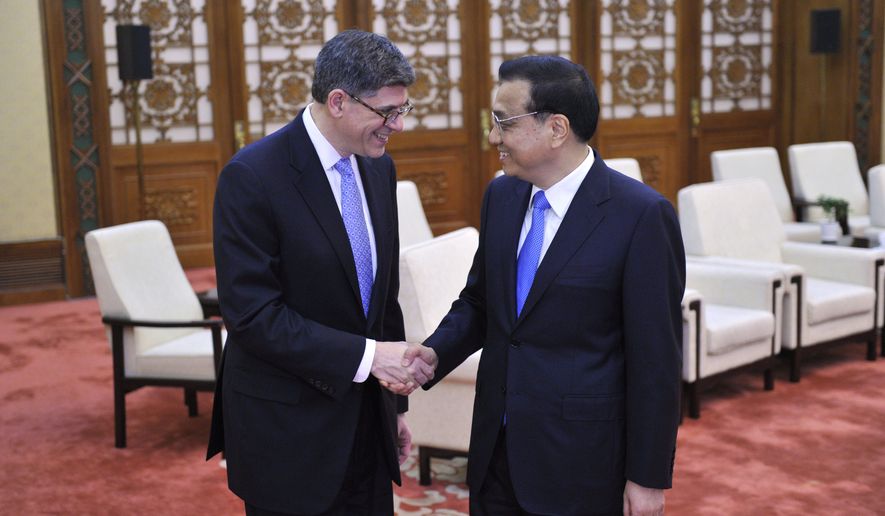

Treasury Secretary Jacob Lew, in a possible attempt to mend fences, was in Beijing Monday for talks on a range of economic issues with Chinese Premier Li Keqiang and other officials. Mr. Lew gave no sign that Washington was ready to join the AIIB, but said the Obama administration was willing to work with the bank once it was established.

“We very much welcome China’s increased participation in infrastructure investment, and the concerns we’ve raised about the need for standards continue,” Mr. Lew said, according to The Associated Press, saying talks between Washington and Beijing on the AIIB have been “cooperative and collaborative.”

“The initial decisions of what kinds of projects are invested in will obviously be a very important signal as to how they’ll proceed,” Mr. Lew added.

Chinese officials have been careful not to gloat about the spectacle of longtime U.S. allies ignoring Washington in the rush to have a stake at the new bank, in no small part because China’s massive reserve, huge domestic market and global clout are too attractive to ignore.

“The AIIB is expected to increase investment, boost demand and spur economic expansion in the region,” said Zhu Min, a former top official at the People’s Bank of China and now deputy managing director of the IMF.

SEE ALSO: Obama humiliated as allies join China’s Asian Infrastructure Investment Bank

But outside observers say the episode marks a clear diplomatic defeat of the U.S. and an equally clear sign of a shift in the global economic pecking order. British Prime Minister David Cameron began the rush of top powers to join the AIIB earlier this month, giving little advance warning to the U.S. or to Britain’s European Union partners.

“Confusion is the result, and further friction and conflict inside the EU, in the G7 and across the Atlantic are foreseeable,” wrote Volker Stanzel, a senior adviser at the German Marshall Fund of the United States in a new analysis of the AIIB fight. “’Divide and rule’ is an art mastered long ago by Beijing.”

• David R. Sands can be reached at dsands@washingtontimes.com.

Please read our comment policy before commenting.