OPINION:

This week is “Sunshine Week,” a nonprofit, nonpartisan national initiative launched by the American Society of News Editors to “promote a dialogue about the importance of open government and freedom of information.” What better time to focus on a provision of the Dodd-Frank Act that allows the Financial Stability Oversight Council (FSOC) to designate companies it deems “too big to fail” as “systematically important financial institutions” (SIFIs) subject to enhanced supervision and regulation by the Federal Reserve.

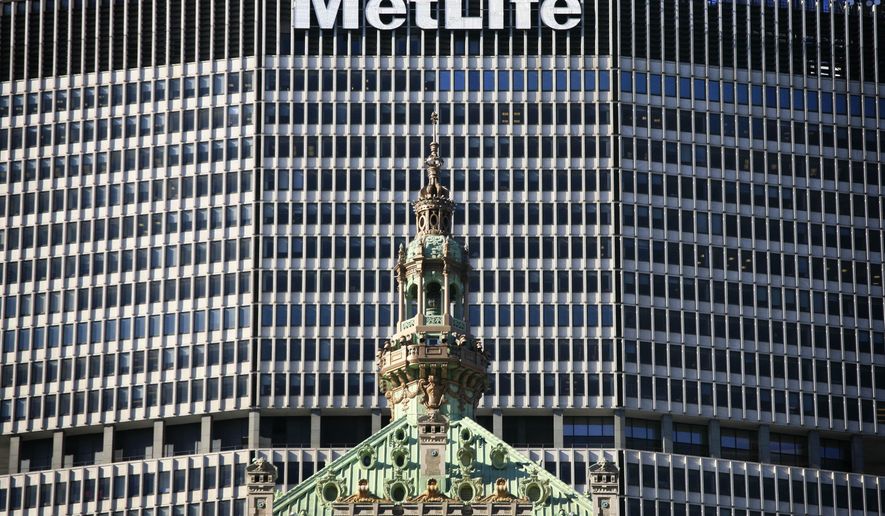

It has done so with MetLife, the largest life insurance company in the U.S. MetLife rejects the SIFI designation, maintaining that it is a pillar of stability that, in the words of a source familiar with the controversy, “remained strong even during the 2008-09 financial meltdown — during which time it neither requested nor received any bailout money.”

MetLife, unable to get any meaningful information from FSOC about why it received the designation and about the specific criteria used to determine it, has filed suit in the U.S. District Court for the District of Columbia, “challenging a final decision by the Council to designate MetLife as a nonbank systemically important financial institution (’nonbank SIFI’).” The company asks the court to set aside the designation and enjoin FSOC from taking any further action until standards for designating non-banking companies as SIFIs have been established and made public.

Unfortunately, the FSOC does not have to give meaningful reasons for its decisions. Dodd-Frank exempts FSOC from the Federal Advisory Committee Act, better known as the federal “open meetings” law, which is why the sun needs to shine in. The Senate Banking Committee is expected to review the FSOC’s decision-making procedures as part of hearings scheduled for March 24, according to the Wall Street Journal, for the purpose of taking “a look at accountability and transparency” issues surrounding FSOC.

MetLife reports its financial health is good and that the FSOC “failed to understand, or give meaningful weight to, the comprehensive state insurance regulatory regime that supervises every aspect of MetLife’s insurance business.”

Journalists preoccupied with Hillary Clinton’s secret email account and her reluctance to answer questions about it should also be concerned with the refusal of the FSOC to provide MetLife with information that caused the government agency to issue its order. MetLife says it has been denied its “due process” guaranteed by the Constitution.

The company is also raising separation of powers arguments because of the multiple roles FSOC members play, serving as rule-maker, investigator, prosecutor, judge and jury. The company brief states: “FSOC members perform a legislative function by adopting rules that purport to set the standards used to determine whether to designate companies (as SIFIs); an executive and prosecutorial function by proposing companies to be subject to the standards they have promulgated, investigating those companies, and building the case for designation; and an adjudicative function by issuing final decisions adopting their own proposed rationales. Not only is each of these functions performed by the same body, they are also performed by the same individuals, without even a separation into offices or divisions.”

MetLife says all of its requests under the Freedom of Information Act have either been ignored or denied by FSOC. Under any definition of fairness, much less equality under the law, a company should have the right to know why it is being regulated by a federal agency. In this case, MetLife appealed the ruling, but the FSOC rejected the appeal.

After promising to be the most transparent administration in history, the Obama administration increasingly behaves like a dictatorship in matters it wants to keep from the prying eyes of its own citizens.

Next year will mark the 50th anniversary of the Freedom of Information Act, passed by Congress and signed by President Lyndon Johnson. Open government ensures that government better serves the people. Closed government leads to citizens becoming servants of the state.

Transparency laws mean nothing if they are not respected, obeyed and enforced. Federal agencies that ignore the law should be held accountable. The MetLife lawsuit offers one opportunity to put big government back on its side of the Constitution. The Senate Banking Committee’s hearing on FSOC closed-door meetings offers another. “Sunshine Week” is a good time to turn up the heat.

Cal Thomas is a syndicated columnist.

Please read our comment policy before commenting.