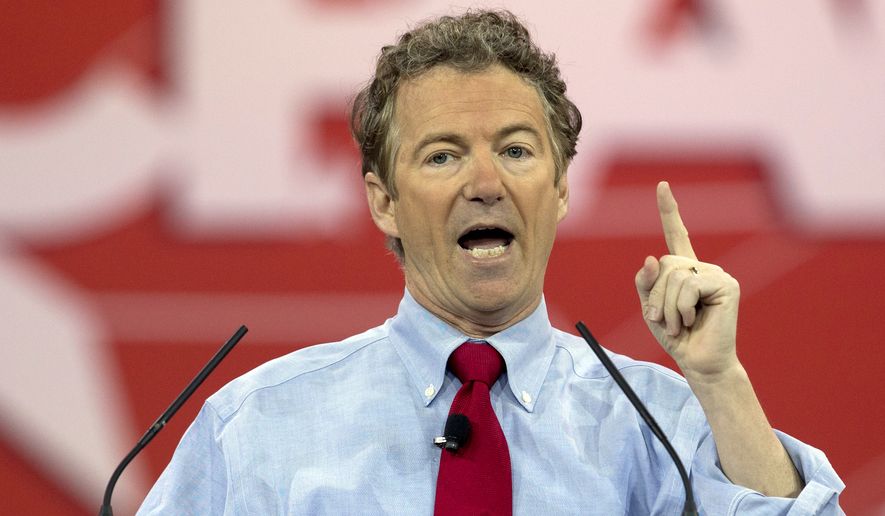

Rand Paul, the Kentucky senator and 2016 Republican presidential hopeful, is leading an effort to repeal a tax law prized by President Obama but despised by millions of Americas who live and work outside the United States.

Mr. Paul formally introduced legislation this month in the Senate to reverse the main requirements of the Foreign Account Tax Compliance Act, saying the law has wrongly deprived American ex-patriots of access to banking services, violated their privacy and forced many to renounce their citizenship.

“Not only is FATCA dangerous with respect to the privacy protections owed to every American — home or abroad — it has threatened the livelihood of millions of Americans working or living overseas,” Mr. Paul said.

One of those is Roger G. Johnson, a U.S. Army major in the first Iraq War who says the law forced him to face agonizing personal and financial decisions just so he could continue working in the Czech Republic with his wife.

“I once got trapped in an enemy minefield with no good choices — getting hit with FATCA felt a bit like that,” said Mr. Johnson, who “had to choose between renouncing my U.S. citizenship or face onerous tax penalties.”

Speaking from a home he maintains in Fresno, California, he added, “I am a proud American who served his country in uniform during wartime as well as in peacetime. I was born an American and never considered that any circumstance could arise which could cause me to consider renouncing my U.S. citizenship.”

SEE ALSO: Rand Paul joins Democratic senators to push marijuana legalization bill

FATCA has forced him to go through the expensive and arduous process of transferring his property to his wife’s name.

His situation was like many of the 7.6 million Americans who live abroad and are affected by FACTA.

The law was passed by a Democratic Congress and signed by Mr. Obama in 2010 with the stated goal of preventing Americans living overseas from cheating on their taxes. But the law has had far-reaching consequences beyond that.

It requires foreign banks to monitor and report to the Internal Revenue Service on the banking of Americans residing overseas or risk severe punishment.

Mr. Paul said the reporting requirements violate the privacy guaranteed by the Constitution and added a costly burden on banks, many of whom have chosen to stop serving overseas Americans rather than comply.

“As a result, the private data of American accounts is forfeited, and foreign banks have approached the onus of this law by shutting their doors to U.S. citizens,” Mr. Paul said.

If Americans like Mr. Johnson cling to their U.S. citizenship, they face double taxation by the U.S. and foreign governments and huge financial penalties because, they say, the Obama law rests on the assumption that all Americans living and working abroad are tax cheats — and so are automatically treated as guilty until they can prove innocence.

The senator first introduced legislation in 2013 to reverse the impact of FACTA, but it went nowhere in a Democratic-controlled Senate. With Republicans now in charge, he hopes to move the bill to the floor for a vote. It has no co-sponsors yet and was referred to the Senate Committee on Foreign Relations for initial review.

Whether the bill advances or not, it gives Mr. Paul a forum to raise some of his favorite issues — tax fairness, privacy and government overreach — as he gears up his 2016 presidential bid.

“Rand’s bill would unarguably repeal FATCA by erasing the act’s seven key provisions,” explained Jim Bopp, a Republican lawyer who also serves as treasurer and general counsel for Republicans Overseas, a group that is going to court to challenge the constitutionality of FACTA.

Mr. Johnson is a plaintiff in that lawsuit.

• Ralph Z. Hallow can be reached at rhallow@gmail.com.

Please read our comment policy before commenting.