OPINION:

I’m asked every day if America is the next Greece or Detroit or Puerto Rico — and the answer is an unequivocal no. The U.S. economy — especially the private sector — is structurally very healthy. That wasn’t the case on the eve of the great financial meltdown of 2008 when American companies and households were leveraged up to their eyebrows.

What’s different today from eight years ago is that now it’s the government that’s in the fiscal intensive care unit while companies and households have rebooted.

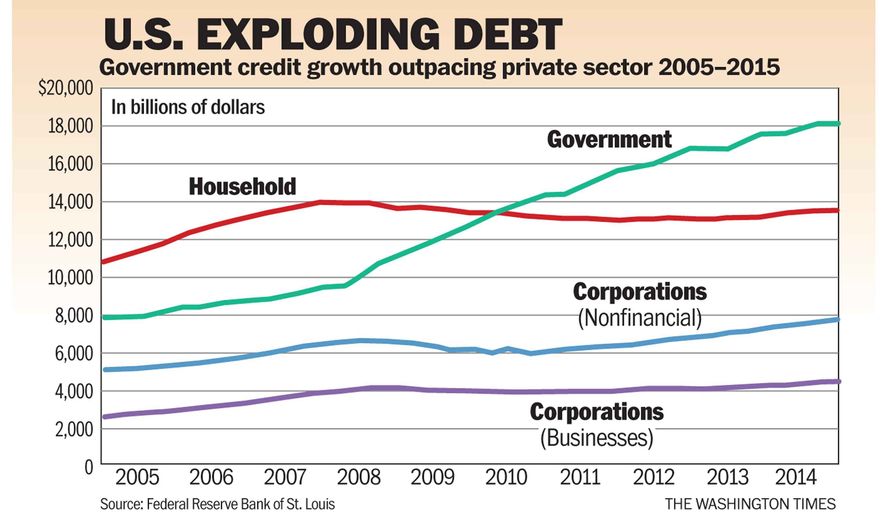

The stunning improvement in business and family balance sheets is arguably the most impressive and under-reported characteristics of this U.S. recovery (see chart). The latest government statistics indicate that the private sector has massively deleveraged following the debt binge from 2000 to 2008.

The story is simple: Over the past seven years American companies have become hyper- and even ruthlessly efficient, which has meant shedding unproductive operations and reducing employment, cutting debt burdens, and focusing on profitability. It’s the reason the stock market has soared since 2008. Companies are now sitting on $1 trillion to $2 trillion of reserve cash, according to The Wall Street Journal, and balance sheets are generally pristine. Households have cut their debt, too.

But the borrowing statistics from the Bureau of Economic Analysis and compiled by economist David Malpass of Encima Capital also reveal that there has been one sector of the economy that has been largely immune from this American de-leveraging crusade: the government.

We have here a tale of two economies. At a time when private-sector debt burdens have flattened out and even fallen, the government debt has soared frighteningly from $8 trillion to $16 trillion. If there is a fundamental structural weakness in the economy holding back growth, this is it.

As the private sector has become lean and cost-conscious, government has become flabbier and more dependent than ever on debt. The numbers are even worse for government when including trillions of dollars of unfunded liabilities in pension and health care obligations.

By the way, the statistics on borrowing also don’t include the $4 trillion of assets now held on the balance sheet of the Federal Reserve — which largely include mortgage-backed securities and federal Treasury bills.

The government’s borrowing binge didn’t happen by accident. It was by design. Back in 2008 and 2009, the Keynesian economic modelers advised government that with the economy in collapse, now was the time to borrow even more money (government debt had already climbed from $5 trillion to $8 trillion from 2000 to 2008) to prop up demand for goods and services. On the face of it, this theory was always a non sequitur. Since unprecedented borrowing created the financial crisis in the first place, how could more debt spending by Washington be the solution? It wasn’t. One summer after another has passed without a robust recovery and we are now $1.5 trillion behind the average recovery in gross domestic product growth.

When I recently debated Paul Krugman of The New York Times and I showed him these statistics, he argued that it was a good thing the government borrowed so much when the private sector was deleveraging or else the economy would have collapsed again. He argues the reason the Obama stimulus failed was that it was too small and that $7 trillion in federal borrowing should have been as much as twice as large. This is the best that the deep thinkers of the left can come up with.

Now borrowing isn’t inherently bad — it depends a lot on what the debt is financing. But under President Obama, government bought all the wrong things. Huge increases in debt went to finance welfare programs such as food stamps, housing subsidies, unemployment insurance, Obamacare subsidies, green energy failures like Solyndra, giveaway tax credits, high-speed rail to nowhere in California and the like. The rate of return on these “investments” was close to zero. Very little was used to increase the productive capacity of the nation through tax cuts or even infrastructure improvements. Many of the extreme Keynesians advised that it didn’t matter what the government spent the money on, because we would get a “multiplier effect” from the spending and borrowing.

It turned out that the borrowing blitz led to fewer jobs and less output than the Obama administration predicted we would see if we had not spent $830 billion in 2008 on the “stimulus” in the first place. It was a fiscal drag, not a fiscal stimulus.

The end result of this $7 trillion avalanche of federal borrowing from the government has been to divert more credit to the public sector and less to private businesses and households. This has been the “crowding out” effect of government spending and borrowing policies.

In the years ahead, as we strive for higher growth rates of 4 percent or more, we would like to see the opposite trend of the last seven years. The private sector should be borrowing more, but in a responsible way, to finance future growth, and the government should be tightening its belt and borrowing much, much less. In other words, it’s time for government austerity and private-sector expansion.

That is the way to prevent America from becoming the next Greece.

• Stephen Moore is a senior fellow at the Heritage Foundation and a Fox News contributor.

Please read our comment policy before commenting.