OPINION:

If there were ever a right time to eliminate the estate tax in America, it is right now. The latest tax collection data make an overwhelmingly persuasive case for abolishing the most immoral and counterproductive of all federal taxes.

Here is what the latest Internal Revenue Service numbers tell us: In 2013, the estate tax raised $12.7 billion. And estate tax revenue is falling, not rising. In 2001 the tax collected nearly twice as much money as 2013 ($23.5 billion).

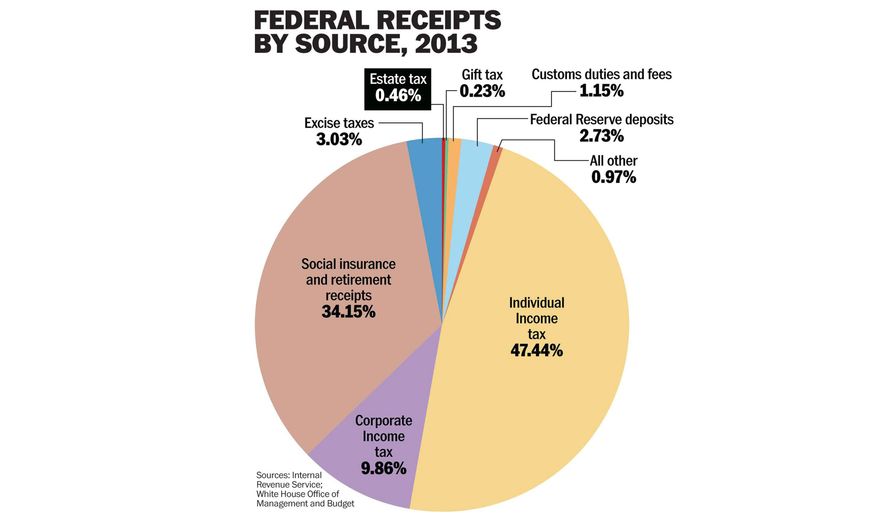

This $12.7 billion raised was out of about $2.8 trillion in total federal revenue in 2013. In other words, a trivial 0.46 percent of federal tax receipts now come from estates. Its impact on the federal deficit is minimal. If we got rid of the tax altogether, the feds at worst would still collect more than 99 percent of all federal revenues.

The chart compares the share of federal taxes that comes from the death tax to other major revenue sources.

Why does the tax raise such a pittance? Partly because the exemption level was raised to $5 million, indexed for inflation (rising to $5.4 million this year) as part of the tax deal in 2012. The tax rate was also cut to 40 percent from 55 percent. But the other factor that appears to be driving lower collections is that wealthy Americans are getting savvier in avoiding the tax. Which brings us to the stupendous inefficiency of the tax. In 2013 only 4,687 estates paid any estate tax. This was about one-fifth of a percentage point of all deaths that year. Yet nearly every medium-sized estate has to waste time and money filling out catalogs of tax forms. The joke in legal circles today is that we have an estate tax not to raise money, but to put thousands of accountants and lawyers in jobs.

The common objection screamed from the rooftops to eliminating this tax is this: It’s a tax cut for rich trust fund babies.

Actually, no. Most of the billionaire households — Gates, Buffett, Rockefeller — will pay almost no estate tax. In the case of Bill Gates and Warren Buffett, billions of dollars of their wealth is sheltered from the IRS through the creation of tax-exempt entities like the Gates Foundation. In many cases the income parked there will never be taxed, either, while they are alive or after they are dead — thanks to this mother of all tax shelters.

Dick Patten, who runs a coalition of family business owners dedicated to ending the death tax, reminds me that the third plank of Karl Marx’s and Friedrich Engels’ “The Communist Manifesto” was to abolish all rights of inheritance. “With a 100 percent inheritance tax, the government eventually owns everything. That’s the point, right?” And with an effective federal 57 percent inheritance tax as President Obama has proposed, the government in some cases owns more than half.

This is all so economically self-defeating. Nobel laureate economist Joseph Stiglitz, who served as chairman on Bill Clinton’s Council of Economic Advisers, once found in a research paper that the estate tax may increase inequality by reducing savings and driving up returns on capital. Former Clinton Treasury Secretary and Obama economic adviser Larry Summers co-authored a 1981 study finding that the estate tax reduces capital formation. And a 2012 study by Republicans on the Joint Economic Committee showed that since its inception, the estate tax has reduced the capital stock by approximately $1.1 trillion since its introduction nearly a century ago.

The major propeller of growth in a nation is that one generation after another leaves wealth to the next. This makes societies richer over time as trillions of dollars of wealth are passed to children and grandchildren. The higher the tax rate the less the incentive for wealth creation in the first place. The incentive is to die broke — in which case future generations get nothing, but the government gets shut out too. This is called a lose-lose for everyone.

Amazingly, many socialist or former communist nations such as Sweden and Russia have eliminated their death taxes. They found it to be economically counterproductive. America should do the same — at almost no cost to the Treasury, according to the new revenue numbers, and maybe even a big gain.

• Stephen Moore is chief economist at the Heritage Foundation.

Please read our comment policy before commenting.