OPINION:

The ongoing COVID-19 virus pandemic is continuing to wreak havoc on developed and developing economies. Most businesses, large and small, have either shut down or significantly curtailed their operations. Large segments of the blue-collar workforce have either been laid off or furloughed.

There are two underlying causes of this business retrenchment. First, the obvious reason, businesses are being mandated by their city or state government to either shut down or severely curtail operations.

Second, perhaps more important though less obvious, is the unprecedented increase in business environment uncertainty, including (1) the unknown impact of the pandemic on a company’s employees, customers and supply chain, (2) uncertainty about the time period over which the pandemic impacts different industries, (3) uncertainty about the size of the market and competitive landscape post-pandemic, (4) magnitude and timing of transfer payments to businesses and their employees from the federal government, and, finally (5) direct and indirect impact of the pandemic on future taxes.

Corporate investment policy has been studied by corporate finance scholars for the better part of the past century. The net present value investment decision rule is a well-accepted paradigm. Firms will invest in a new project if the expected cash flows are positive. As expected cash flows increase, businesses are more likely to invest. Equally important, as the uncertainty of these cash flows increases, businesses are less likely to invest. Policies that increase expected cash flows, and decrease the uncertainty of future cash flows will help increase corporate investment activity.

Corporations make three broad types of investments: (a) investments in tangible assets, like plant and equipment, (b) investments in intangible assets, like R&D and brand name, and, most importantly (c) investments in hiring and training their employees. In recent research, we analyzed more than 10,000 U.S. companies during 1971-2015 and document that a 10 percent increase in business environment uncertainty leads to a 6 percent decrease in tangible investment, a 14 percent decrease in intangible investment, and a 37 percent decrease in corporate employment. We further find that these relationships are stronger during economic recessions.

We measure business environment uncertainty using an index developed by University of Chicago economist Steve Davis and colleagues. These economists construct a news-based business uncertainty index by considering business uncertainty related articles in 10 major U.S. newspapers (USA Today, the Miami Herald, the Chicago Tribune, The Washington Post, the Los Angeles Times, the Boston Globe, the San Francisco Chronicle, the Dallas Morning News, the Houston Chronicle, and The Wall Street Journal).

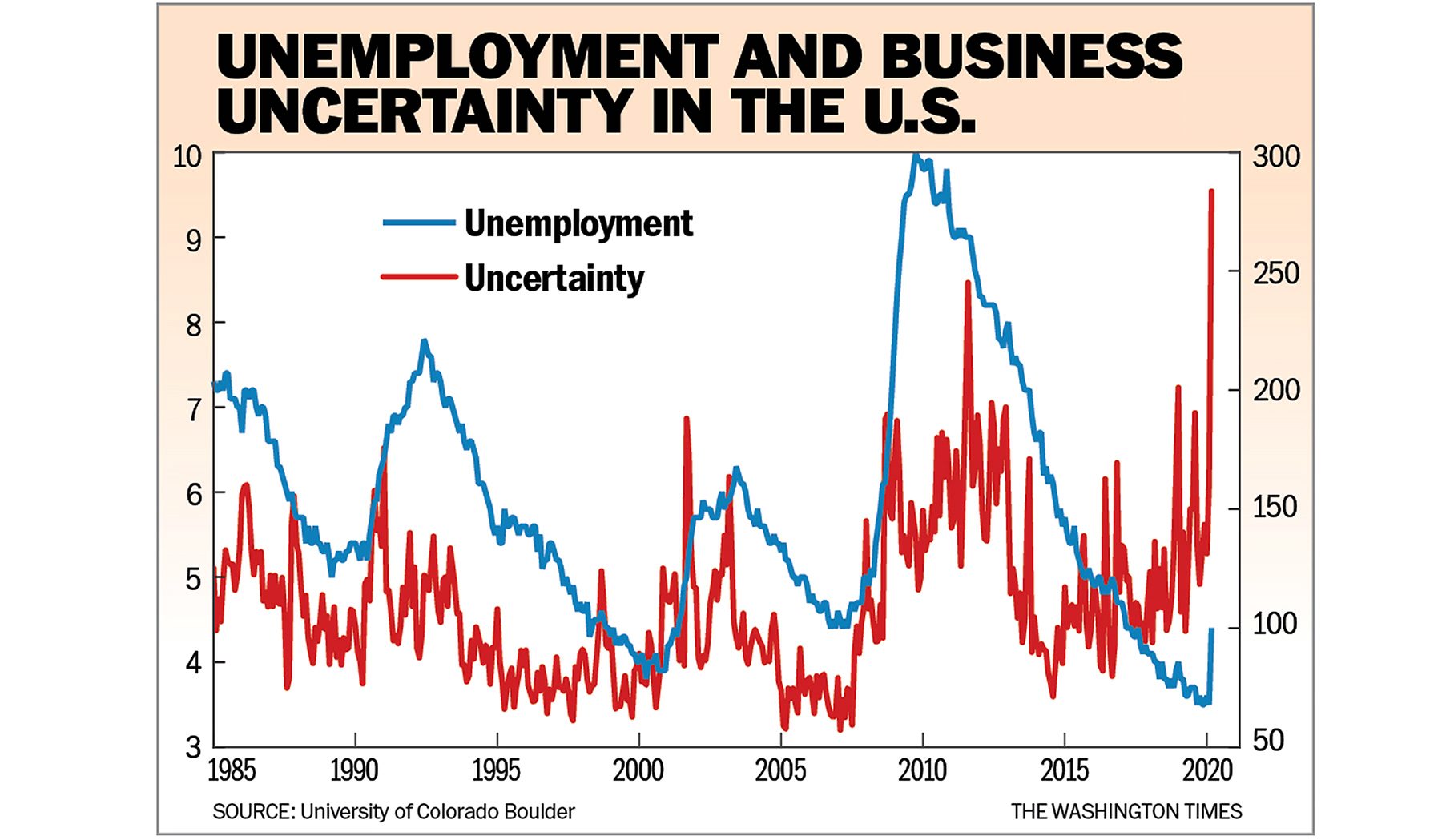

Their business uncertainty index includes the news index and two other indices, namely, temporary tax provisions in the federal tax code and disagreement among economic forecasters of government expenditures. They report monthly values of this index from January 1985 thru March 2020. Per this index, business uncertainty is at its highest in March 2020 during the period 1/1985-3/2020. Not only is the business uncertainty index largest for March 2020, it is larger than the next highest business uncertainty index measure by more than 40 percent. (See figure.)

This puts into perspective the unprecedented level of current business uncertainty in the U.S. economy. The figure also highlights that for each of the 12 months prior to March 2020 (that is, February 2018 thru February 2020), the unemployment rate is the lowest during the period illustrated (1/1985-3/2020).

As the figure suggests, and consistent with earlier research noted above, business uncertainty and unemployment rate are related. We measure this relationship several ways.

First, we find a strong positive correlation between the level of business uncertainty and several different measures of unemployment. We find that more than 30 percent of the variation over time of the unemployment rate is explained by business uncertainty.

Second, we find that greater the increase in business uncertainty, greater is the increase in unemployment rate. We find a 10 percent increase in business uncertainty is associated with a 0.5 percent increase in unemployment rate. We use a model to forecast the unemployment rate in the coming months by considering both (a) the unprecedented high level of business uncertainty in March 2020, and (b) the increase in business uncertainty between March 2019 and March 2020.

Our model forecasts an unemployment rate of 11 percent in the coming months. This devastating high unemployment rate is the direct result of the unprecedented level of business uncertainty caused by the pandemic.

• Sanjai Bhagat and Shrihari Santosh are finance professors at the University of Colorado Boulder.

Please read our comment policy before commenting.