OPINION:

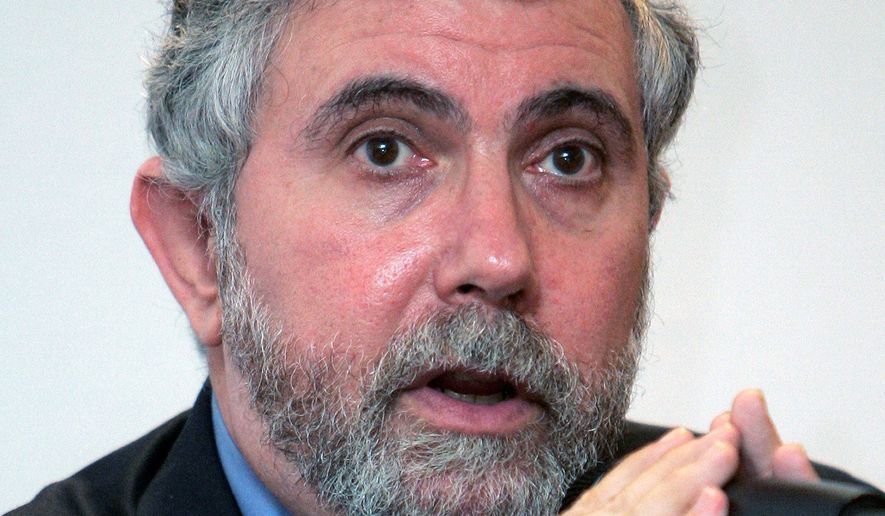

The men and women who pick the winners of the Nobel Prize should come in from the cold — the temperature Tuesday in Oslo was 44 degrees — and after their brains thaw out they should ask Paul Krugman to send back his Nobel medal, awarded in 2008. Both high and low numbers continue to puzzle the man.

Economics is called “the dismal science” for a reason, but Mr. Krugman took the description seriously on election night last November, delivering himself of what he imagined was wisdom when it was coming clear that Donald Trump, against the predictions of every pollster with a clipboard, had been elected president of the United States.

He finished writing a column for The New York Times early on the morning after, assuring his readers that the world’s stock markets, which were slumping at the time, would “never” recover.

He said the election of such an “irresponsible, ignorant” man would inflict “the mother of all adverse effects” on the economy. “So we are very probably looking at a global recession, with no end in sight.” Mr. Krugman is still looking.

Perhaps that did happen on the planet where Mr. Krugman lives, but U.S. consumer confidence has since climbed to its highest level in more than 16 years. The Conference Board’s consumer-confidence index rose from 116.1 in February to 125.6 in March, the best reading since December 2000.

The index measures consumers assessment of current conditions and their expectations for the future. Both were up in March.

The “renewed optimism suggests the possibility of an upside for the prospects for economic growth in the coming months,” says Lynn Franco, director of economic indicators for the Conference Board. The survey further finds that more Americans expect hiring and incomes to increase over the next six months, and nearly a third of them describe business conditions as “good.”

The Conference Board’s new numbers follow the November reading of the National Federation of Independent Business small-business optimism index, which jumped to 98.4 from 94.9. Released in mid-December, that represented its sharpest surge since 2009 — not coincidentally, about the time President Obama began eight years of spreading reams of regulatory red tape across the economy.

The Conference Board’s report arrived on the day that Ford Motor Co. announced it would invest $1.2 billion at three factories in Michigan, including $850 million at an assembly plant to make the new Ford Ranger pickup and Ford Bronco SUV.

“Major investment to be made in three Michigan plants,” Mr. Trump tweeted early Tuesday, even before Ford executives made the official announcement. “Car companies coming back to U.S.,” he said with his familiar all-capitals and excess of exclamation points. “JOBS! JOBS! JOBS!”

Ford executives insisted that the investments had been planned long before the president took office, but it’s nonetheless a reflection of the automaker’s confidence in the U.S. economy generally, and in the success of the automobile market in particular. Under some other president the investments could just as easily have been postponed or canceled.

Mr. Trump can reasonably argue that Ford might have had other ideas but for his jawboning over the previous 17 months to bring domestic manufacturing back from abroad.

Mr. Krugman shared his gloom with certain other economists. “If the unlikely [election of Donald Trump] happens, and Trump wins,” Steve Rattner said on Election Day on MSNBC, “you will see a market crash of historic proportions, I think.”

The Dow Jones industrial average has gone nowhere but up since then. The Dow closed at 18,613.52 on Nov. 9; at 19,732.40 on Jan. 20; and at 20,701.50 on Tuesday. Chicken Little was not pleased.

Please read our comment policy before commenting.