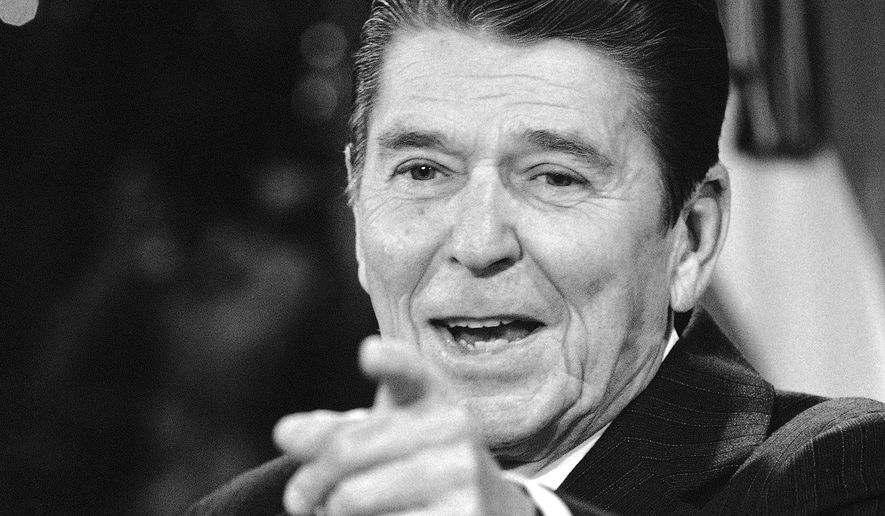

Official government statistics flatly contradict arguments Forbes contributor Adam Hartung advanced recently, that President Obama has outshined President Reagan in kick-starting growth. (See it here.)

Mr. Hartung lauds the steep drop in unemployment achieved in just five years under Mr. Obama, compared to Mr. Reagan’s results over eight years — this is misdirection away from alarming, still unresolved developments.

The unemployment ratio is only one metric that analysts use to assess economic health, and it is not calculated consistently, over time, by the U.S. Bureau of Labor Statistics.

As Lance Roberts notes in an excellent posting on www.zerohedge.com, unemployment statistics from the Obama era certainly understate joblessness now compared to the Reagan era.

Instead of relying upon an inconsistently applied and ancillary measure, study a core driver of true economic progress: trends in employment within the private sector.

Before Reagan took office in 1981, the peak level of private sector employment (converting part-time employees to full-time equivalents) was 71.2 million in 1979.

During the first two years of Reagan’s presidency, private sector jobs dropped to 69.7 million. Starting in 1984, they jumped to 74.4 million, steadily increasing until 1988, when they reached 82.6 million — a cumulative 16 percent increase from the Carter era peak.

In stark contrast after five years, Mr. Obama’s record shows no growth whatsoever, judged from recent pre-inauguration peak levels.

In 2007, full-time equivalent private sector jobs were 108.9 million and by 2013 they were 106.9 million, down a cumulative 2 percent.

A second element of Mr. Hartung’s comparison is economic growth, as measured by gross domestic product, adjusted for inflation.

As Simon Kuznets astutely observed in 1934, statistics such as GDP are, at best, rough approximations of underlying reality that mask significant underlying shifts inside an economy. (Read it here.)

A profound change in attitudes toward borrowing between 1981 and 2013 is one example of a shift that skews GDP calculations as these ignore changes in debt levels.

During the Reagan years, when our nation was underleveraged financially, Americans adjusted borrowing habits — a practice that boosted reported GDP significantly.

Under Mr. Obama, America’s addiction to financial leverage inside households, businesses, financial institutions and governments reached epic proportions that severely threaten all of us now.

To see the danger, look at the ratio of total debt compared to private sector wages — a conservative way to assess credit capacity.

From 1981 through 1988, total debt averaged five times private sector wages. From 2009 through 2013, this leverage ratio nearly doubled to 9.7 times.

Gains reported in economic growth will turn to sharp losses when America is forced to reduce our total borrowings down to prudent levels.

The weakest link in Mr. Hartung’s argument is a focus on relative performance in broader stock market indices.

Since 2008, extraordinary actions taken by our central bank and by other influential central banks pushed benchmark interest rates down and elevated traded values of most assets, as explained here and here.

This intervention cannot continue much longer because a long-forestalled and perhaps record correction is overdue.

Absorbed with breaking foreign developments that continue threatening the American homeland, we need to understand that the Obama administration has not actually resuscitated the domestic economy.

Danger rises everywhere.

Please read our comment policy before commenting.